College Admissions

College Admissions

Preparing for College

The Best College for You

What to Study

Applications

Education Options

Education Options

Private Universities

Public & State Universities

Community Colleges

Scholarships

Scholarships

African American Scholarships

Latino Scholarships

Native American Scholarships

Women Scholarships

College Grants

College Grants

Federal Grants

Merit Based Grants

Need Based Grants

Student Loans

Student Loans

Federal Student Loans

State Student Loans

No Co-signer Student Loans

Bad Credit Loans

Student Loan Consolidation

College Survival

College Survival

Financial Aid Tips

The Digital Student Blog

Today the written word features extensive hype and hyperbole. After all, that is what draws readers to a paper or web site.

So it was no surprise for us to come across the following headline: The Awful Reality Of America’s Student Loan Nightmare.

At first, it sounds like a massive case of overhype does it not?

Well, such a title is rendered much more relevant when we understand that it is on a web site such as BusinessInsider.com. Then, when one reads the article and learns of the debt some students have accumulated we have to agree the term nightmare is more than apropos.

Consider further the Chronicle of Higher Education and its recent independent research on the topic.

Consider further the Chronicle of Higher Education and its recent independent research on the topic.

According to their data, of the student loans that entered repayment in 1995, one of every five has since gone into default. That’s correct, fully 20% of those who borrowed could not meet the expectations set forth in their repayment schedule.

Fast Forward to 2010

While one in five is truly scary, one needs to understand that the average student loan debt from that period was roughly $13,000. Today it is nearly double that figure, $23,000 plus.

One might suggest, using simple math, that fifteen years from now we might expect a doubling of the rate of default.

So no, the crisis isn’t hyperbole. According to the Wall Street Journal, “consumers now owe more on their student loans than their credit cards.” According to the June 2010 figures from the Federal Reserve, Americans owe some $826.5 billion in revolving credit. The total owed on student loans comes to $829.8 billion, according to Mark Kantrowitz, publisher of FinAid.org and FastWeb.com.

Over at the Huffington Post, op ed writer Zac Bissonnette noted the Chronicle data and went on to note that defaults are only the tip of the iceberg when it comes to the impact of student loans. Many students who were not in default likely managed to stay in good standing only by accepting career options based on pay instead of goals and lifestyle choices based on debt as opposed to following their heart.

Bissonette writes:

“Looking at the default rate as a measure of difficulty in repayment is a lot like analyzing obesity in America by looking at the percentage of people who are so fat that they’re unable to get out of their chairs.”

Avoid the Nightmare

For the most affluent students such horror tales are likely irrelevant. After all, the cost of college is not much of an issue for those with means.

But for the average American, the cost of a four-year degree is more than significant. And sadly, for most students, that extensive price tag becomes affordable only when loans are considered.

But students must understand that college loan debt is far different than credit-card debt. First and foremost, college loans generally can’t be discharged in bankruptcy.

Second they often have very different repayment terms. Those terms often have heavy consequences for anyone who misses payments.

Before Taking any Loans

Yes, the crisis is for real. And today’s tough economic times are only exacerbating the issue for grads who took out loans.

So before you are enticed by the lure of a college degree and the draw of a life on-campus, think carefully about how you are going to pay for that experience. There are a number of important things to consider before agreeing to any loans in your financial aid package.

So before you are enticed by the lure of a college degree and the draw of a life on-campus, think carefully about how you are going to pay for that experience. There are a number of important things to consider before agreeing to any loans in your financial aid package.

We suggest you take the time to review Six Things To Know Before Taking Out A Student Loan published at Forbes.com. All of the suggestions are extremely important though there are two we definitely want to highlight.

Number three notes you must have a sense of your probable earning potential after you graduate. In simplest terms, if you are studying to be a teacher you cannot take on the same debt load as someone studying to be a doctor. The average student loan debt of $23,000 is most likely too much for someone entering the teaching profession.

And number six notes you have to set an amount you are willing to borrow. It is imperative that students do their homework up front to be able to set a dollar amount limit on what they will borrow based on their future goals. Once that has been set, students will have a real sense of what they can truly afford in their choice of a school, whether or not they can afford to live on campus or must commute from home, whether to work part-time and attend school part-time, etc.

Across the Atlantic there have been discussions about a radical new way for students to pay for college. Instead of either cutting programs or raising tuition, governmental officials are proposing the possibility of defraying increases and paying for those costs by assessing taxes against a student’s future earnings.

According to the Daily Mail, the majority of the students in the UK currently take out loans of about £3,225 a year at low interest rates and pay them back after they graduate. The process is analogous to that of the US except the debt level of students in the UK is limited.

Tuition fees are assessed as a flat rate charge generally paid in installments after a person graduates. However, the poorest students in the UK are not required to pay back any funds while the student debt for the more affluent is still limited to a specific amount.

But as with America, UK universities are currently faced with cutting services or raising fees. According to the Daily Mail, rather than make programming cuts, administrators want to increase fees by about £5,000 a year.

A Graduate Tax

As a possible different option, the idea being floated is to impose a graduate tax that would require students pay a percentage of their future earnings for a specific time period. Such a concept means that the payback amounts would vary from student to student depending on what he or she earns in the future.

As a possible different option, the idea being floated is to impose a graduate tax that would require students pay a percentage of their future earnings for a specific time period. Such a concept means that the payback amounts would vary from student to student depending on what he or she earns in the future.

Critics immediately pounced on this fact insisting that those students earning more would in effect be penalized. The Mail reports that the Russell Group of top universities “calculates that graduates in the upper 20 per cent of earners could end up paying at least £16,000 a year – far more than the cost of their education.”

However, as America grapples with making education more affordable and increase access to higher education for the neediest students, the graduation tax represents an interesting approach. First and foremost, if tuition and fees were waived, higher education would truly be affordable to students from all walks of life.

Second, graduates who struggle to find jobs initially often have their entire future placed in jeopardy especially if they had to borrow a significant amount to pay for school. Those individuals face enormous pressures when the six month loan deferment period ends and the initial payment schedule begins.

One Possible Prong

When it comes to addressing the issues of higher education, both the affordability of college and the desire to have more students pursue a degree, federal and state government would do well to examine the graduate tax option. A modest percentage assessed against future earnings could prove to be a very viable exchange for those first generation college students struggling desperately to find money to attend school at this point in their lives.

In addition, making that option available only to those who attend a community or state university branch would ensure more students would pursue education at the most reasonable cost. While we are not convinced that the major concern being expressed is legitimate, it would be easy to take care of the issue of those who earn more money being forced to pay back far more than those who earn less. Creating a time period certain and a cap on total payback would easily take care of any issues.

Of course, we would prefer the UK option of no payback as well as no tax for the most needy students. But faced with higher costs and the potential for significant debt, some American students would seemingly do well if the graduate tax option existed.

In a tough economy you cannot afford to make any mistakes with your application packet.

Over the past three years, good-paying jobs have become exceedingly tough to come by, even for those with a college diploma. Unfortunately, many grads are making the application process more difficult for themselves.

The current recession has rendered some traditional job search practices obsolete. Those who fail to take notice of those changes are doomed to a fruitless search.

1. Create a Unique Cover Letter for Each Application

The concept of creating one cover letter then cutting and pasting salutations is a definite no-no today. Because computers make it easy to fire off countless professional-looking documents with a simple change of the header, companies are now looking beyond the appearance.

It remains true that a professional cover letter remains critical, a simple spelling or grammatical mistake can get your whole application packet tossed into the recycling pile. Employing your spell check and grammar features can help, but you still may want to have someone with proof-reading skills double check that element for you.

It remains true that a professional cover letter remains critical, a simple spelling or grammatical mistake can get your whole application packet tossed into the recycling pile. Employing your spell check and grammar features can help, but you still may want to have someone with proof-reading skills double check that element for you.

However, even more importantly, the content of the letter matters today. Many companies now use automated tracking devices to initially examine application packets submitted online. Those devices first hone in on the key words and phrases from the job description of the opening.

Those scanners can be programmed to search for the name of the company in the body of the letter as well as some of the company’s specific attributes. Your letter must directly address and mention these key elements.

Furthermore, your letter must indicate why you are the right person for the opening. Otherwise your entire application packet could be tossed before your resume is reviewed.

2. Create a Unique, Easy to Review Resume

As with your cover letter, the content of your resume must also match up with the scanning devices. Again, creating one generic document will not cut it – your resume must match up with the company and its respective job opening.

While you may think highlighting academic awards from high school or college will get you noticed, they are secondary to a resume featuring relevant content. Having those respective key words and phrases in your goal statement and when relevant, in your work or academic experiences, are critical in getting your resume past any businesses employing scanners in the search process.

However, to ensure that your document passes muster with those employing the old-fashioned personal touch, it is helpful to have a concise, skimmable resume. Make it professional (free of typos and grammatical mistakes), but also make it brief, relevant and too the point.

3. Provide References

Once upon a time, it was copacetic to end your document with the generic phrase: references available on request. No more. Today’s job market demands that you provide all the necessary information the recruiter or human resource professional needs to evaluate you appropriately.

Most employers will do some homework before inviting people in for an interview and that homework may well include checking references first. If you have not provided that information and other worthy candidates have, the recruiter will no doubt start with those who have provided the info. If they are happy with what they find out, they simply will not take the time to contact you.

Lastly, for new grads, such a ‘references available on request line’ may be seen as an attempt to hide the fact that you may not have any quality ones to list.

4. Take and Make the Offered Interview Time

It is important to understand that an interview request is a clear indication that you have survived the initial review process. That means this company has interest in you.

Unless you have another job interview scheduled at the time offered, make every effort to work the offered time into your schedule. If you are fortunate, you may get offered a couple of options.

Unless you have another job interview scheduled at the time offered, make every effort to work the offered time into your schedule. If you are fortunate, you may get offered a couple of options.

Some grads think such flexibility sends a message that they have little going on in their lives, especially on the career front. But in reality making yourself available sends the message you are truly interested in this particular opening.

And whatever you do, don’t be late!

5. Review the Company Web Site

It is imperative that you take the time to review the company web site. First, a brief scan can be critical to providing you those key words and phrases that will make your cover letter and resume stand out.

Even more important, if you get an interview opportunity you will be asked questions about the company. Those questions are designed to let hiring managers know if you have done some homework on both the company and the prospective opening.

Once again, the key is to create a good impression. Knowing about the company and understanding their needs once again sends the message you are truly interested in working for them.

How many times have you tried, unsuccessfully, to explain your feelings to adults?

That you love the competition and the socialization that video games provide. That you simply enjoy trying to figure the game out.

As for the violent games, well, they add that one additional level, providing action and a rush of adrenalin that mirrors what you feel when competing on a field or in the gym.

Most importantly, they help you cope with anger and stress. After a particularly difficult day or week, there is nothing like immersing oneself in a violent video game. I mean, where else can you take out your anger in such an innocent way?

Most importantly, they help you cope with anger and stress. After a particularly difficult day or week, there is nothing like immersing oneself in a violent video game. I mean, where else can you take out your anger in such an innocent way?

That explanation is particularly difficult with mom who can understand the competition and thus is willing to accept games like Pac Man or Madden football. But for the life of her, she simply cannot understand your enjoyment with a game like Grand Theft Auto?

Support for Violent Video Games

Well, for those who have tried to somehow explain, you can now point the skeptics to yet another study that indicates that concerns with violent video games is over blown. That in fact, researchers presenting at the New York University ‘Games for Learning’ symposium, have reached the conclusion that even violent video games can be utilized as learning tools.

Consider first that Sigmund Tobias of the State University of New York at Albany noted that an “Israeli air force study found that students who played the game Space Fortress had better rankings in their pilot training than students who did not.”

Even better, consider what Daphne Bavelier, an assistant professor in the department of brain and cognitive science at the University of Rochester who has focused her research on games like Unreal Tournament and Medal of Honor, had to say about fast-paced shooter games:

“People that play these fast-paced games have better vision, better attention, and better cognition,” she stated. She went on to suggest that such games could well improve math performance and other brain tasks as well.

“People that play these fast-paced games have better vision, better attention, and better cognition,” she stated. She went on to suggest that such games could well improve math performance and other brain tasks as well.

“We are testing this hypothesis that when you play an action video game, what you do is you learn to better allocate your resources,” she offered. “In a sense you learn to learn. … You become very good at adapting to whatever is asked of you.”

Just Having Fun

Of course, none of these has any ultimate implication for why it is that you play. As we said, for most of us, it is all about the competition, the challenge, and the chance to put day to day struggles aside for a period of time.

You couldn’t care less as to whether your peripheral vision has been enhanced or that these games test your ability to detect small activities on the screen. In reality, for you it is nothing more than simply having fun.

But it is nice to see that some folks have begun to question the typical reaction, that because many adults cannot understand the attraction of such games, they immediately insist that the games cannot be good for us. More to the point it is nice to see that a professor like Bavelier could actually suggest that first-person shooter games “eventually will become part of school curricula” even if “it’s going to take a generation” to accept such findings.

Unrealistic to Expect Understanding

OK, it is probably wishful thinking on our part that you might be able to completely change your parents mind. Pointing them in the direction of other studies could even work against you in the long run.

But at least it is reinforcing to read that college professors actually are beginning to understand that you and your buddies love for a little video warfare is not a sign of sickness, that you can enjoy the video games that feature violence without becoming a menace to society.

Medal of Honor anyone?

Readers of our blog know our emphasis on value. For that reason we have noted the importance of the payback ratio and the concept of the honors college.

Furthering our value concept, we have also posted our five reasons to consider your local state university. All told, it is our view that state universities consistently offer some of the best values going.

Furthering our value concept, we have also posted our five reasons to consider your local state university. All told, it is our view that state universities consistently offer some of the best values going.

But such a position must go hand in hand with the most important statistic, college completion. While the public is often bombarded with America’s K-12 school dropout issue, the fact is that college dropout rates far exceed what transpires in the K-12 sector.

These poor results as well as lists of the best and worst college graduation rates recently hit the headlines with the release of the American Enterprise Institute for Public Policy Research’s release of Diplomas and Dropouts (PDF).The private, nonpartisan, not-for-profit institution dedicated to research and education on issues of government, politics, economics, and social has compiled the completion rates of all American colleges and universities.

For the record, the study utilizes the common six-year completion method, i.e. those who complete their degree within six years of entering school. While we would prefer to see summaries of those who complete their program within four years, the six-year figure is the going standard. Those reviewing the report will find the highest and lowest grad rates for students based on school selectivity but the report does not offer a complete breakout for state universities.

Given our ongoing support of state university systems, we took the time to review the AEI report for readers. Below you will find our list of the top ten state universities by graduation rate. All offer very strong numbers.

To be sure, not all of these schools have the same selectivity rating. And readers must understand that we cannot fully articulate the reasons why one school tops another. We do not know if it is because of stronger support for students, better instruction, or the proper level of entrance criteria. In fact we would guess it is most probably a combination of all of these elements and more.

The bottom line is not all schools are as successful as their counterparts. To get a full sense, we also offer a complete summary of all state institutions after our top ten. To give readers some other key data, our final list includes the percent graduation rate, in-state tuition and fee costs, total enrollment and the state graduation percentage (average of all colleges in that respective state).

The Top Ten State Universities by Graduation Rate

1. University of Virginia: 93%

2. University of California, Los Angeles: 90%

3. (tie) University of California, Berkeley: 88%

3. (tie) University of Michigan: 88%

5. (tie) Penn State 84%

5. (tie) University of California, San Diego: 84%

7. University of North Carolina 83%

8. University of Illinois: 82%

9. University of Florida: 81%

10. (tie) University of California, Irvine: 80%

10. (tie) University of Maryland: 80%

All State institutions:

Alabama

University of Alabama: 65% – $5,700 – 23,499

State Average: 42.9%

Alaska

University of Alaska: 20% – $4,477 – 10,990

State Average: 24.0%

Arizona

University of Arizona: 56% – $5,048 – 33,447

State Average: 52.0%

Arkansas

University of Arkansas: 58% – $6,038 – 15,913

State Average: 48.5%

California

University of California, Berkeley: 88% – $7,165 – 33,855

University of California, Davis: 79% – $8,124 – 28,868

University of California, Irvine: 80% – $7,556 – 25,839

University of California, Los Angeles: 90% – $7,165 – 36,733

University of California, San Diego: 84% – $7,456 – 26,466

State Average: 59.7%

* We have provided the data for the five largest branches.

Colorado

University of Colorado at Boulder: 67% – $6,636 – 28,171

State Average: 44.7%

Connecticut

University of Connecticut: 74% – $8,852 – 21,373

State Average: 60.8%

Delaware

University of Delaware: 78% – $8,150 – 18,716

State Average 47.0%

Florida

University of Florida: 81% – $3,257 – 47,600

State Average: 48.0%

Georgia

University of Georgia: 77% – $5,622 – 31,008

State Average: 44.7%

Hawaii

University of Hawaii: 55% – $5,390 – 16,505

State Average: 43.2%

Idaho

University of Idaho: 53% – $4,410 – 10,138

State Average: 41.7%

Illinois

University of Illinois: 82% – $11,130 – 40,248

State Average: 56.3%

Indiana

Indiana University: 72% – $7,837 – 36,151

State Average 53.1%

Iowa

University of Iowa: 66% – $6,293 – 25,685

State Average: 57.0%

Kansas

University of Kansas: 60% – $6,600 – 24,988

State Average: 46.7%

Kentucky

University of Kentucky: 62% – $7,096 – 23,600

State Average: 44.3%

Louisiana

Louisiana State University: 60% – $4,543 – 26,901

State Average: 40.1%

Maine

University of Maine: 59% – $8,330 – 10,130

State Average: 57.4%

Maryland

University of Maryland: 80% – $7,969 – 32,660

State Average: 59.4%

Massachusetts

University of Massachusetts: 66% – $9,921 – 22,655

State Average: 66.6%

Michigan

University of Michigan: 88% – $10,447 – 39,199

State Average: 52.1%

Minnesota

University of Minnesota: 63% – $9,598 – 41,927

State Average: 62.7%

Mississippi

Mississippi State University: 58% – $4,978 – 14,932

University of Mississippi: 53% – $4,932 – 13,977

State Average: 46.1%

Missouri

University of Missouri: 67% – $7,603 – 25,714

State Average: 51.8%

Montana

University of Montana: 42% – $5,141 – 12,129

State Average: 40.8%

Nebraska

University of Nebraska: 63% – $6,216 – 20,781

State Average: 52.5%

Nevada

University of Nevada: 41% – $4,201 – 21,938

State Average: 38.0%

New Hampshire

University of New Hampshire: 73% – $11,070 – 13,620

State Average: 57.3%

New Jersey

Rutgers University: 73% – $10,686 – 31,188

State Average: 57.3%

New Mexico

University of New Mexico: 44% – $4,571 – 20,870

State Average: 40.2%

New York

Stony Brook University: 59% – $5,760 – 20,573

SUNY at Albany: 64% – $6,018 – 15,590

SUNY at Binghamton: 77% – $6,012 – 13,376

SUNY at Buffalo: 61% – $6,218 – 25,252

State Average: 59.6%

North Carolina

University of North Carolina: 83% – $5,340 – 25,089

State Average 50.5%

North Dakota

University of North Dakota: 54% – $6,060 – 10,965

State Average: 44.0%

Ohio

Ohio State University: 71% – $8,676 – 48,583

State Average: 54.5%

Oklahoma

University of Oklahoma: 62% – $6,507 – 21,945

State Average: 38.8%

Oregon

University of Oregon: 65% – $6,174 – 18,902

State Average: 54.3%

Pennsylvania

Penn State: 84% – $12,844 – 41,817

State Average: 64.6%

Rhode Island

University of Rhode Island: 58% – $8,184 – 13,655

State Average: 67.1%

South Carolina

University of South Carolina: 63% – $8,346 – 23,955

State Average: 50.0%

South Dakota

University of South Dakota: 48% – $5,752 – 7,041

State Average: 43.3%

Tennessee

University of Tennessee: 58% – $5,932 – 27,620

State Average: 48.5%

Texas

University of Texas: 78% – $7,670 – 47,490

State Average: 45.8%

Utah

University of Utah: 56% – $4,988 – 22,845

State Average: 50.5%

Vermont

University of Vermont: 72% – $12,054 – 11,061

State Average: 56.1%

Virginia

University of Virginia: 93% – $8,690 – 21,889

State Average: 56.7%

Washington

University of Washington: 75% – $6,385 – 36,120

State Average: 59.2%

West Virginia

West Virginia University: 55% – $4,722 – 25,673

State Average: 42.6%

Wisconsin

University of Wisconsin: 79% – $7,185 – 38,652

State Average: 55.6%

Wyoming

University of Wyoming: 57% – $3,366 – 10,549

State Average: 57.0%

Once upon a time, there was a belief that there was such a thing as a good loan with the general consensus being that the two most common ‘good’ forms of borrowing were home and college loans.

Then came the recent economic downturn and the housing crisis. All of a sudden, many homeowners found themselves owing more on their homes then their houses were worth. That development now has many folks realizing that borrowing funds for a home may not always be a good idea.

In addition to the housing meltdown, the economic crisis has taken a toll on employment opportunities. Those graduating from college this spring are about to enter what has been dubbed the worst job market in years.

In addition to the housing meltdown, the economic crisis has taken a toll on employment opportunities. Those graduating from college this spring are about to enter what has been dubbed the worst job market in years.

With limited job prospects, large numbers of graduating students are being forced to take jobs that do not require a college diploma. If you are one of the students who borrowed significant sums of money only to be forced to take a job waiting tables or bar tending, you now have begun wondering why borrowing for college was ever seen as a ‘good’ idea.

College Grads Seeking Work

According to the Center for Labor Marketing Studies at Northeastern University, the percentage of graduates age 25 and under with a BA degree working in a job requiring a college degree has now dropped below 50 (as of 2009). Therefore, if you are graduating this spring, you face the distinct possibility (a one in two chance) that you will have to enter the work force by taking a job that does not require a bachelor’s degree. Such a development also means that one out of every two graduates cannot expect to earn a salary commensurate with their original career aspiration.

If you are a girl, the survey indicates that you have a slightly better chance to secure a job requiring a college degree. For women 25 and under, 55% (as compared to 49% for men) are currently working in a job that at least requires a college degree.

Worse yet is the data for young adults of Hispanic or African-American descent. For Hispanic males, just 40% of those with a degree are working in a job that requires a diploma. For black males, the number is a paltry 35%.

Loans Due and No Funds to Pay Them

While these percentages represent some of the worst numbers in the past 20 years, the current belief is that the downward trend will continue for the foreseeable future. Given the data, those pursuing a college diploma need to carefully reassess their aspirations. In particular, those thinking about borrowing money to pursue a degree need to carefully take stock of the current job environment.

Data clearly indicates that college graduates who take jobs below their education level will earn less in their initial work years. In fact, it can take seven to nine years to match the earnings of graduates who were able to land career-track employment upon graduation.

When one combines such data with other troubling numbers, that two-thirds of college students are graduating with student loans and that 25% of those who borrow end up owing more than $30,500, the results are startling. That is why 40 percent of seniors surveyed by NACE said they expect to need financial help from their parents after college.

The result is that students in this economic climate who borrowed even modest amounts of money have additional pressures upon them, the need to pay college loans. For that reason, graduates often find themselves taking any job that is offered just so as to begin the process of paying down those loans.

The result is that students in this economic climate who borrowed even modest amounts of money have additional pressures upon them, the need to pay college loans. For that reason, graduates often find themselves taking any job that is offered just so as to begin the process of paying down those loans.

Even when employment options are available, those who borrowed for school are driven to select the job that pays the most. Students with significant debt generally continue to choose options based on what a job pays rather than pursuing the original career that inspired them to attend college in the first place. Significant college debt loads also lead to the potential delay in starting a family and/or buying a house.

When it comes to borrowing for college, the standard rule at one time was not to borrow more than your projected starting salary. Once upon a time, students could roughly gauge just what that starting salary would be.

Given the recent downturn and the difficulty finding work in your chosen field, such projections are no longer valid. In fact, given today’s economic climate, your starting salary will likely be far lower than those original projections for the foreseeable future.

That means that loans of any size will prove extremely challenging to pay off. Ultimately, borrowing money for college during an economic downturns appears to be a very bad idea.

Cell phones and sex don’t mix – and we are not talking about sexting.

One really good thing about surfing the internet, I am usually sitting down when I click on that story of stories – the one that makes me sit up very straight and utter, are you kidding me? Of course, it is usually the s word I utter but you get the point.

The other day I am surfing Arianna’s wondrous site, The Huffington Post, to see which writer is taking that raving maniac Glen Beck to task today when I stumble on to the latest study, this one about cell phone use and texting.

In the realm of you have to be kidding, consider these results:

“Twenty-four percent of users under 25 and 12 percent of users over 25 allow electronic message to interrupt them while they’re in the bathroom.”

Even while on the hopper? Is nothing sacred?

And then this:

“…over 40% of respondents saying they didn’t mind being interrupted for a message. In fact, 32% said a meal was not off limits while 7% said they’d even check out a message during an intimate moment.”

“…over 40% of respondents saying they didn’t mind being interrupted for a message. In fact, 32% said a meal was not off limits while 7% said they’d even check out a message during an intimate moment.”

And, what mind you, constitutes an intimate moment? I guess just what you might think:

“The study found that 11 percent admit to checking updates during sex (6 percent of users over 25 do the same).

“While the scope of this study is fairly limited, the results seem to echo recent findings that estimated 15 percent of Americans have interrupted sex to answer a cell phone call.”

No, nothing appears sacred anymore.

Now I stumbled onto this amazing set of revelations just after catching one of those moments we could dub a fabulous reality, the amazing photo of Tiger Woods tapping away on his cell phone while playing a practice round at the Masters. The amazing moment that will form the perfect photo over at TMZ whenever some other young lady feels the need to come clean and admit she has spent time with Tiger also led to a number of double entendre’s since reportedly Woods was filming his friend Mark O’Meara’s, ahem, putting stroke.

For the cell phone, etiquette-challenged young, we remind you of some of the basics:

Lights Out, Phone Off: Now this usually means that phones should be turned off in movie theaters, playhouses, and other stage venues. The ringer and the lighted screen both deemed as negatives in such a setting. Could it be that the 11 percenters never turn off the lights?

Love the One You’re With: This usually translates to the notion that it is rude to take a cell phone call during a social engagement. Even more pertinent, it is deemed inconsiderate to take a call in the middle of a conversation. If by the slimmest of chances you truly think you must answer, you are supposed to ask permission to do so. Could it be that those who check updates during sex see the act as so distant it does not qualify as either a social engagement or a conversation? And what possibly could your significant other say when you ask, “Mind if take this call?”

Love the One You’re With: This usually translates to the notion that it is rude to take a cell phone call during a social engagement. Even more pertinent, it is deemed inconsiderate to take a call in the middle of a conversation. If by the slimmest of chances you truly think you must answer, you are supposed to ask permission to do so. Could it be that those who check updates during sex see the act as so distant it does not qualify as either a social engagement or a conversation? And what possibly could your significant other say when you ask, “Mind if take this call?”

Use Common Sense: This often translates to turning your phone off before a job interview, your best friend’s wedding or Grampa’s funeral. If the phone should be off anyplace a quiet atmosphere is expected, then why in heaven’s name would it be on in the bedroom?

Employ the Ten Foot Rule: The theory is you should maintain a distance of at least 10-feet from the nearest person when talking on a cell phone. Tough to maintain this standard even in a king size bed.

Times have surely changed. Whereas once upon a time the gentleman held the car door for the lady, today he is just as likely to be the passenger in her car.

Today’s digital world no doubt presents new challenges when it comes to manners and etiquette. That said remember the basics:

Lights Out, Phone Off – Love the One You’re With – Use Common Sense – Employ the Ten Foot Rule.

And then add this one other:

Keep the Personal Personal: on and off the phone.

All federal loans set to follow the Direct Loan program format.

Lost in all the hype over the passage of the landmark health care bill was a provision in the bill to revamp the federal student loan program. The legislation will put an end to the popular FFEL Program and thus push all federal college loans into the Direct Loan format.

The FFEL and DL Programs

The Federal Family Education Loan Program (“FFEL Program” or “FFELP”) is often referred to as the federally guaranteed student loan program. In FY 2008, approximately 75% of all colleges participated in this lending option.

The Federal Family Education Loan Program (“FFEL Program” or “FFELP”) is often referred to as the federally guaranteed student loan program. In FY 2008, approximately 75% of all colleges participated in this lending option.

As opposed to the loans originating from the federal government, in the FFEL program the loan funds come from banks and other financial institutions. Because of the large number of entities offering such loans, colleges participating in the FFEL program were able to maximize borrower choice.

In addition, the FFEL program offered the same set of loan options as the Direct Loan program: Stafford, PLUS and Consolidation loans.

Funds for the William D. Ford Federal Direct Loan Program (“Direct Loans” Program or “DLP”) come directly from the US Department of Education (which gets the funds from the US Treasury). Because of the funding source, this source of aid has not experienced the same funding issues as FFELP has during the current credit crisis.

Program Differences

Critical differences have begun emerging within the two programs. First, as noted above, as the credit crisis worsened and banks tightened their lending practices, less money was available to students in the form of FFELP loans. In contrast, DLP loans remained available.

Unfortunately, the Ensuring Continued Access to Student Loans Act of 2008 (ECASLA) did not address funding issues in all loan programs, just the Stafford and PLUS loan programs. The indirect result was that consolidation loans originating after October 1, 2007 became unprofitable for FFEL program lenders. Because of that development, most of the FFELP lenders have stopped offering consolidation loans.

In contrast, consolidation loans continued to remain available from the Direct Loan program but borrowers in the FFEL program generally could only consolidate their loans by moving into the Direct Loan program.

Two other major differences tend to make the Direct Loan option a better one for students. First, the interest rate on the PLUS loan maxes out at 8.5% in the FFEL Program. For the Direct Loan program, the maximum rate tops out at 7.9% for the PLUS. However, the interest rate on the Stafford Loan is identical in both programs.

Independent analysis has revealed that parents are more likely to obtain a PLUS loan approval in the Direct Loan program than in the FFEL program. The 2007-08 National Postsecondary Student Aid Study (NPSAS) suggests that the Parent PLUS loan denial rate in the FFEL program in 2007-08 was double the Parent PLUS loan denial rate in the Direct Loan program.

Independent analysis has revealed that parents are more likely to obtain a PLUS loan approval in the Direct Loan program than in the FFEL program. The 2007-08 National Postsecondary Student Aid Study (NPSAS) suggests that the Parent PLUS loan denial rate in the FFEL program in 2007-08 was double the Parent PLUS loan denial rate in the Direct Loan program.

Lastly, the new Public Service Loan Forgiveness option is available to students only in the Direct Loan program.

Customer Service Impact for Students

On the plus side, according to the Congressional Budget Office estimates, eliminating the middleman from the loan process will save the federal government between $6 billion and $7 billion per year. Those savings are reportedly possible because the government has paid private banks billions of dollars in subsidies to encourage those institutions to loan to students.

On the negative side, the changes will result in the loss of a number of valuable agencies.

But for most college students, the major question centers upon how the legislation affects them and their families. The answer is that it will impact students according to their financial status.

An enormous increase this year in Pell grants was set to create a major shortfall in fund for many low-income students. The legislative change ensures that the Pell grant program will not only remain solvent, it will provide annual increases in the maximum grant allocation for the foreseeable future.

An enormous increase this year in Pell grants was set to create a major shortfall in fund for many low-income students. The legislative change ensures that the Pell grant program will not only remain solvent, it will provide annual increases in the maximum grant allocation for the foreseeable future.

Second, the funding level for students will be more secure. Therefore, those students who recently found loans drying up during the fiscal crisis will now know that such funds will remain available.

Lastly, the legislation will do nothing to negatively impact existing loans including private loans. But for those individuals who later qualify for the Income-Based Repayment Program, the capped rate will drop from 15% to 10% of discretionary income and shorten the repayment window from 25 to 20 years.

In actuality, the greatest impact will be felt with the school’s financial aid officers. One critical outcome is that those individuals will no longer play a role in which private lenders are used to originate those loans for students.

But of course, at this point, only the House has approved the bill. The Senate is scheduled to take up the bill later in the week.

There is a great deal of hope among college basketball fanatics for a KU vs. UK NCAA Final in 2010. For those not in the know, KU is Kansas University, the number one overall seed in the tournament. UK is the University of Kentucky, the team with the best overall player in freshman John Wall.

But I for one am hoping for a different result. I am hoping that Kentucky gets banished quickly for more reasons than the man who was hired to coach the team.

Each year, Derrick Z. Jackson, an African-American editorial writer for the Boston Globe, takes the time to scrub the NCAA graduation data. He is not easily fooled by the likes of the National Collegiate Athletic Association interim president Jim Isch who earlier this year implied that the NCAA emphasis on academics had helped raise the overall graduation rate for college basketball nearly 10 percentage points over the last eight years.

Each year, Derrick Z. Jackson, an African-American editorial writer for the Boston Globe, takes the time to scrub the NCAA graduation data. He is not easily fooled by the likes of the National Collegiate Athletic Association interim president Jim Isch who earlier this year implied that the NCAA emphasis on academics had helped raise the overall graduation rate for college basketball nearly 10 percentage points over the last eight years.

Those rooting for a Kansas-Kentucky final should look at some of the data Jackson has uncovered. First off, he notes that Kentucky cannot really boast of academics at all, not with a basketball Graduation Success Rate of just 18 percent for its black athletes. And not when its GSR for basketball is but 31 percent overall.

In fact, Jackson did some extensive digging and found that Kentucky’s graduation rate for its black players over the last six years tops out at 18%. The five other years the school posted black graduation rates of 17, 9, 17, 17, and zero. And just to clarify that he is not cherry picking, going back ten years the black player graduation rate has never risen above 29 percent.

It is important to recognize that these rates do not reflect the all-too-often explanation offered by sports junkies – that these top programs post poor rates simply because their athletes leave early for pro basketball. The fact is, the NCAA adjusts these graduation-rate reports for those players leaving a school, for pro basketball or for another school, as long as those athletes were in good academic standing at the time they made the move.

So you will not find me rooting for Kentucky to make it to the finals. Especially not with a coach who has twice left programs that have had their accomplishments rescinded because of rule infractions.

In addition, I no longer can root for Duke, a school that does graduate its players yet accepts athletes to fill out its athletic rosters that do not have the requisite SAT scores or academic qualifications that non-athletes must have to be accepted at the school.  If you care about the idea that the NCAA tournament is supposed to involve amateurs enrolled in a college, then you will not root for Maryland (a zero black graduation rate the past three years and 8 percent currently overall), Texas (black graduation rates the past three years of 29, 14 and 22 percent), Nevada Las Vegas (black player grad rates of 13, 10, 10, 14, and 17 percent the last five years), or the University of California at Berkeley (a GSR for both its black and white players of zero – as opposed to the overall campus graduation rate of 85 percent (62 percent for black students). Other teams that stretch the term student-athlete beyond recognition are New Mexico State, Washington, Missouri, Arkansas-Pine Bluff, and Baylor.

If you care about the idea that the NCAA tournament is supposed to involve amateurs enrolled in a college, then you will not root for Maryland (a zero black graduation rate the past three years and 8 percent currently overall), Texas (black graduation rates the past three years of 29, 14 and 22 percent), Nevada Las Vegas (black player grad rates of 13, 10, 10, 14, and 17 percent the last five years), or the University of California at Berkeley (a GSR for both its black and white players of zero – as opposed to the overall campus graduation rate of 85 percent (62 percent for black students). Other teams that stretch the term student-athlete beyond recognition are New Mexico State, Washington, Missouri, Arkansas-Pine Bluff, and Baylor.

Instead, you could do as I and pull for the teams that play high caliber ball and play it with student-athletes. Try anyone of the following, all posting grad rates of 90% or more: Brigham Young, Notre Dame, Utah State, Wake Forest, Wofford, Lehigh, Vermont and Villanova.

I guess, of the top four seeds I could live with Kansas, a respectable 73% GSR, or Duke, graduating the folks it accepts with a GSR of 92%, making it to the finals. But while Kentucky is abysmal, the final top four selection, Syracuse, is no shining star either with a GSR of 50%.

Imagine a day when the NCAA would put its reputation in front of dollars and cents and actually insist on some minimum graduation standards for those teams accepted to the Big Dance.

Once upon a time, it was lumped together with the harshest of drugs. But in recent years marijuana has started claiming a new place in society.

As states continue to enact medical marijuana usage legislation, those responsible for implementing the new laws have been charged with designing growth and distribution requirements and protocols. The result is an emerging industry that some think could one day rival a significant sector of the pharmaceutical industry.

As a student, dare we even say it, you may be interested in knowing there is a college that features training in this emerging field.

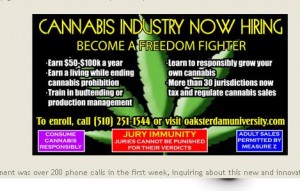

Oaksterdam University

Founded in November 2007 by Richard Lee, Oaksterdam University sounds like a high school dropout’s dream. The school began with an “extremely provocative advertisement in the East Bay Express proclaiming ‘Cannabis Industry Now Hiring’.”

Inspired by his visit to the cannabis college in Amsterdam, Lee envisioned a school that offered a different program than the horticulture focus of the college in Amsterdam.

Inspired by his visit to the cannabis college in Amsterdam, Lee envisioned a school that offered a different program than the horticulture focus of the college in Amsterdam.

While offering a program that still does fundamental study in horticulture, Lee expanded on the cannabis college idea to create a trade school. His idea was to try to legitimize the cannabis industry, particularly as it relates to the field of medical marijuana.

According to the school’s web site, “20 lucky and trailblazing students packed into a small classroom in Oaksterdam located on 15th Street” in what was to be the first official course offering. That class reportedly was taught by some of the biggest names in the cannabis industry: Chris Conrad, Richard Lee, Lawrence Lichter, and Dennis Peron.

Soon armed with a 3-month waiting list for class openings, the school began expanding. As class sizes grew, course offerings grew in frequency and in format.

In 2008, Lee opened a satellite school in Los Angeles. Later, when Michigan passed its medical cannabis law, Oaksterdam University brought its program to Ann Arbor and held the first Michigan class in May of 2009.

Shortly thereafter, the latest campus, North Bay in Sebastopol, California was opened. And in November of 2009 the main campus branch moved to a sprawling 30,000 sq.ft. campus at 1600 Broadway, in Oakland. The new campus is home to numerous classrooms, two auditoriums, a grow lab, and a theater.

Course Programs

Oaksterdam University offers two distinctive formats. For those with a casual interest, the school offers a number of weekend seminars at $250 per seminar.

For those with a desire to learn more about cannabis, the school also offers a comprehensive Semester Program called the Classic Semester. This format meets once a week for 13 weeks with two and a half hours of instruction per class (a total of roughly 32 hours of instruction) and costs $650.

In addition to expert instructors and the guest speakers, each week also includes a comprehensive grow lab experience. According to the Oaksterdam site, accomplished horticulturists walk students, week-by-week, through growing their first garden.

Those students choosing the Semester Course may earn a number of certificates. The school offers two fundamental certificates: a Certificate of Attendance for those who attend all classes and a Certificate of Completion for those who attend all classes, complete the midterm and pass the final.

In addition, for the more industrious, the school offers a Certificate of Completion with Honors. To receive such designation a student must also complete all weekly homework assignments and attend a field trip, in addition to the basic attendance and exam criteria. Lastly, a Certificate of Achievement with Honors is awarded to the Class Valedictorian, and in some cases, to those demonstrating “extraordinary levels of valor and volunteerism.”

For those wondering more about the curriculum, the Classic Semester offers an eclectic mix of topics including two Horticulture offerings: Horticulture and Horticulture: Advanced Grow. It also offers several legal units including: Federal Vs State Law; Legal Rights; and a Know Your Rights workshop.

For those wondering more about the curriculum, the Classic Semester offers an eclectic mix of topics including two Horticulture offerings: Horticulture and Horticulture: Advanced Grow. It also offers several legal units including: Federal Vs State Law; Legal Rights; and a Know Your Rights workshop.

As for an understanding of the medical marijuana industry, other units offered include Politics & History; Patient Relations (formerly Budtending); Dispensary Operations (formerly Dispensary Management); and Procurement & Allocation (formerly Distribution),

In addition, time is spent on three Methods of Ingestion offerings: Extracts; Cooking (includes a step-by-step tutorial on how to make cannabutter); and Vaporizing. There is also a science offering called The Science of Cannabis (formerly Medical Cannabis) as well as two business based offerings: Economic$ and Cannabusiness: Legal Business Structures.

The goal of the program is simple – to help a student either prepare for

employment in a dispensary or to start a business of their own.

Interested Students

Students interested in enrolling will be pleased to learn that admission is essentially first paid, first served. No one is interested in your GPA, or your SAT scores. There is no need to have a wealth of extracurricular activities on your resume – the school doesn’t even ask for a resume.

But if you think it is all a walk in the park you may want to think again. If you are worried that your well-to-do uncle may disown you for selecting this career path you need to understand that your real, personal information must be included on your enrollment form. A failure to provide accurate information (no fictitious names like Token White) could result in your being denied a seat in the class.

And unfortunately, there are no scholarships available. Oaksterdam University indicates it needs your tuition to cover expenses. The school currently does not offer any online courses.

And there is also that matter of a test, albeit optional, for those students who want certification from Oaksterdam University. To pass, students need a score of 75% or better.

And there is also that matter of a test, albeit optional, for those students who want certification from Oaksterdam University. To pass, students need a score of 75% or better.

Lastly, there are required textbooks: Marijuana Horticulture: The Indoor/Outdoor Medical Grower’s Bible, by Jorge Cervantes ($29.95 + tax), and Buds For Less, by SeeMoreBuds ($18.95 + tax). There is also a required DVD purchase: Busted! Flex Your Rights ($16.00 + tax).

Worse yet, there is even recommended supplemental texts if you are serious about the subject. They are not required mind you, just suggestions to expand your education. They include the Marijuana Medical Handbook, the Big Book of Buds Version 3, the Marijuana Garden Saver, Ask Ed, Marijuana Gold: Trash to Stash, Marijuana Cooking: Good Medicine Made Easy, and Organic Marijuana, Soma Style: The Pleasures of Cultivating Connoisseur Cannabis.

Most importantly, those who take their out of school studies/experiments/time too seriously need to understand that class attendance is expected. Refunds are not available for missed classes unless 7 days prior notice is provided (apparently planned parties may work).

A Leg Up?

And when it comes to promises, the school makes no pretenses about the certification that students can earn. When it comes to applying for a job at a dispensary, the school “hopes” that the certification program will give a student an advantage in the selection process over someone who is not certified.