College Admissions

College Admissions

Preparing for College

The Best College for You

What to Study

Applications

Education Options

Education Options

Private Universities

Public & State Universities

Community Colleges

Scholarships

Scholarships

African American Scholarships

Latino Scholarships

Native American Scholarships

Women Scholarships

College Grants

College Grants

Federal Grants

Merit Based Grants

Need Based Grants

Student Loans

Student Loans

Federal Student Loans

State Student Loans

No Co-signer Student Loans

Bad Credit Loans

Student Loan Consolidation

College Survival

College Survival

Financial Aid Tips

The Digital Student Blog

Across the Atlantic there have been discussions about a radical new way for students to pay for college. Instead of either cutting programs or raising tuition, governmental officials are proposing the possibility of defraying increases and paying for those costs by assessing taxes against a student’s future earnings.

According to the Daily Mail, the majority of the students in the UK currently take out loans of about £3,225 a year at low interest rates and pay them back after they graduate. The process is analogous to that of the US except the debt level of students in the UK is limited.

Tuition fees are assessed as a flat rate charge generally paid in installments after a person graduates. However, the poorest students in the UK are not required to pay back any funds while the student debt for the more affluent is still limited to a specific amount.

But as with America, UK universities are currently faced with cutting services or raising fees. According to the Daily Mail, rather than make programming cuts, administrators want to increase fees by about £5,000 a year.

A Graduate Tax

As a possible different option, the idea being floated is to impose a graduate tax that would require students pay a percentage of their future earnings for a specific time period. Such a concept means that the payback amounts would vary from student to student depending on what he or she earns in the future.

As a possible different option, the idea being floated is to impose a graduate tax that would require students pay a percentage of their future earnings for a specific time period. Such a concept means that the payback amounts would vary from student to student depending on what he or she earns in the future.

Critics immediately pounced on this fact insisting that those students earning more would in effect be penalized. The Mail reports that the Russell Group of top universities “calculates that graduates in the upper 20 per cent of earners could end up paying at least £16,000 a year – far more than the cost of their education.”

However, as America grapples with making education more affordable and increase access to higher education for the neediest students, the graduation tax represents an interesting approach. First and foremost, if tuition and fees were waived, higher education would truly be affordable to students from all walks of life.

Second, graduates who struggle to find jobs initially often have their entire future placed in jeopardy especially if they had to borrow a significant amount to pay for school. Those individuals face enormous pressures when the six month loan deferment period ends and the initial payment schedule begins.

One Possible Prong

When it comes to addressing the issues of higher education, both the affordability of college and the desire to have more students pursue a degree, federal and state government would do well to examine the graduate tax option. A modest percentage assessed against future earnings could prove to be a very viable exchange for those first generation college students struggling desperately to find money to attend school at this point in their lives.

In addition, making that option available only to those who attend a community or state university branch would ensure more students would pursue education at the most reasonable cost. While we are not convinced that the major concern being expressed is legitimate, it would be easy to take care of the issue of those who earn more money being forced to pay back far more than those who earn less. Creating a time period certain and a cap on total payback would easily take care of any issues.

Of course, we would prefer the UK option of no payback as well as no tax for the most needy students. But faced with higher costs and the potential for significant debt, some American students would seemingly do well if the graduate tax option existed.

Growing up, I wasn’t a big fan of playing chicken. The version we played was rather innocuous in the greater scheme of things; riding one-speed bikes at one another until someone veered away certainly represented a rather harmless version of the concept.

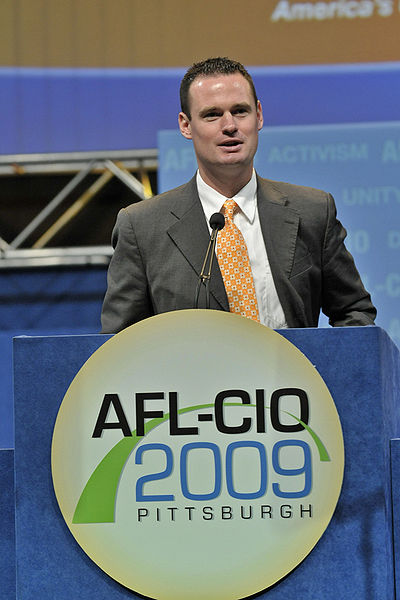

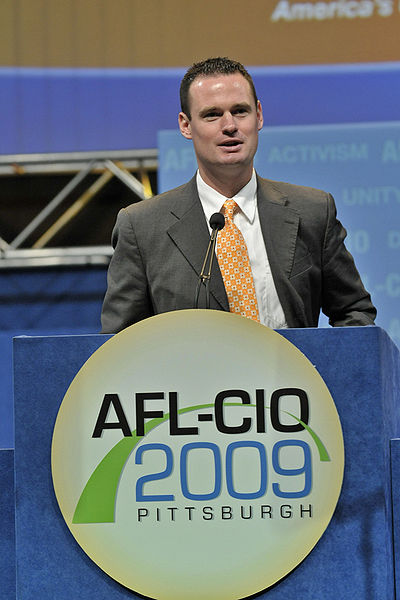

But in what was clearly a version of the longstanding game, Pittsburgh Mayor Luke Ravenstahl apparently has dropped his proposed tax request. For those not up on the issue, Ravenstahl had been seeking a one percent tax on college tuition to help offset city revenue shortfalls.

The fundamental key to the proposal was Ravenstahl’s assertion that nonprofits were falling short of paying their fair share of city costs. But according to news sources, six weeks after insisting the tuition tax was a critical component of the city’s financial future, the mayor has dropped a request that he appeared ready to pursue through the courts if need be. But in an amazing development, he stood with a group of people that included university presidents to announce he was dropping the proposal based on a promise of help from schools and other tax exempt corporations.

The fundamental key to the proposal was Ravenstahl’s assertion that nonprofits were falling short of paying their fair share of city costs. But according to news sources, six weeks after insisting the tuition tax was a critical component of the city’s financial future, the mayor has dropped a request that he appeared ready to pursue through the courts if need be. But in an amazing development, he stood with a group of people that included university presidents to announce he was dropping the proposal based on a promise of help from schools and other tax exempt corporations.

At the news conference, Ravenstahl cited a promise from the University of Pittsburgh, Carnegie Mellon University and Highmark Inc. to donate a larger sum of money to the city than they had previously pledged. In addition, he insisted that university leadership, the city council and other corporate leaders would work to craft a plan that would then be physically taken to Harrisburg (home of state government) to change specific rules related to the city’s finances.

Increasing Taxes

While raising taxes in a recession is normally deemed a political nonstarter, Ravenstahl had previously proposed a number of revenue enhancements to help the city solve its financial woes. Two publicized suggestions involved increasing the $52-a-year tax on people who work in the city and expanding a current tax on payrolls to include previously tax-exempt employers.

But it was Ravenstahl’s proposal, a first-in-the-nation 1 percent tuition tax, that has received the most attention. And while higher education in the city received significant early support in its opposition to the idea, news accounts had a significant legal battle looming, especially since a council majority appeared to be in support of the measure.

With both the city and higher education about to potentially spend exorbitant sums of money on legal expenses, it seems that the mayor may have managed to get the schools to turn away first. The developments seemed to be akin to giving in to the mayor’s demand earlier in the month for a pledge of $5 million in donations in return for dropping the tax.

In a sign that they at least understood how things might look to the public, Pitt Chancellor Mark A. Nordenberg told sources the universities were not “negotiating under the force of the pressure of the tax.” Carnegie Mellon President Jared Cohon added, “We’re not pledging a contribution in order to get rid of the tax. We are prepared to pledge a contribution as the tax is gotten rid of.”

But in a clear sign the mayor got the attention of the nonprofits, the institutions have decided to rethink their prior contribution commitments. Adding yet another feather in the mayor’s cap was the suggestion that future agreements with individual organizations will be made public.

But in a clear sign the mayor got the attention of the nonprofits, the institutions have decided to rethink their prior contribution commitments. Adding yet another feather in the mayor’s cap was the suggestion that future agreements with individual organizations will be made public.

According to blogger Mark Potter, nonprofits have not been contributing their fair share. “Some of the city’s biggest employers,” writes Potter, “its institutional non-profits, are still paying the least to support city operations.

“… until the tuition tax came along, nonprofits this year were content to shell out a voluntary donation that was less than two thirds of what they contributed back in the 1990s. Name another constituency in this city — residents, for-profit business, commuters — whose non-voluntary obligations have dropped that much.”

Tuition Tax

While state representatives have suggested that the mayor’s tax proposals were “half-baked” or “misguided,” the nation was watching the tuition tax levy very carefully. The idea has been postured in a number of other cities, particularly in light of current fiscal environments that have many state and local governments facing revenue shortfalls despite continued demand for much-needed services.

In today’s economic downturn, city governments face tea-party-like resistance to any suggestion of raising taxes. In contrast, colleges across the country still raised tuition and fees amidst the severe economic downturn.

That step certainly caught the attention of more than just the student population. Meanwhile, the subsequent events in Pittsburgh should certainly serve as a wake up call for all non-profits – ante up, or else.

Either that, or you soon will be playing a political game of chicken as well.

The city of Pittsburgh is abuzz over the announcement of Mayor Luke Ravenstahl’s proposed plan to institute a 1 percent tax on college tuition for the 2010 budget.

Calling the revenue enhancement the “Fair Share Tax,” Ravenstahl has estimated the proposal could raise as much as $16 million for the city. And while conservatives would insist this is just another case of taxing anything that moves, Ravenstahl sees it otherwise.

Calling the revenue enhancement the “Fair Share Tax,” Ravenstahl has estimated the proposal could raise as much as $16 million for the city. And while conservatives would insist this is just another case of taxing anything that moves, Ravenstahl sees it otherwise.

When it comes to the students taking classes within city limits, it is “the city and its taxpayers” that “bear the burden of providing them with services” states Ravenstahl. The youthful mayor goes on to claim that the “Fair Share Tax” idea is a result of his inability to fairly tax commuters and non-profit institutions.

Colleges Have Themselves to Blame

Naturally students and college officials have raised an uproar over the proposal. But as we muddle through what many experts call the greatest financial challenges since the Great Depression, state and local governments are struggling to balance their books as their revenues decline. All across the country, those same agencies, faced with enormous budget shortfalls, are making massive cuts to services. Without further revenues, those agencies will need to cut services much further over the next few years.

Meanwhile, colleges have dealt with the financial crisis by raising the cost of tuition and fees. According to web sources, at private four-year colleges, the increase was 5.9 percent over the prior year. At public four-year colleges, the increase was 6.4 percent over the prior year. Those increases simply reflect an ongoing trend that has continued unabated for the past thirty years and have critics insisting higher education has dealt with the fiscal crisis by passing the problem on to their students.

And of course, when it comes to fees, colleges and universities have written the book on how to add extra charges. Today’s typical college bill will include a lengthy list of fees from technology to student activity to labs to the parking sticker on a car, all above and beyond the basic tuition and room and board charges. Talk about taxing anything that moves.

Flat Percentage Concept

What makes the proposal so interesting to many outside the field of education is the notion that it would be a 1 percent tax on tuition. With private colleges now topping more than $30,000 a year in tuition, the tax would hit students much harder at what are often dubbed the “elite schools.”

In contrast, at community and public colleges, where tuition is much cheaper, the student assessment would be much lower. This of course has a few folks insisting that the tax may actually be fair. That stated, those who attend the wealthier schools would insist they do not consume a larger portion of the city’s services than say students from a school where tuition was much lower.

In contrast, at community and public colleges, where tuition is much cheaper, the student assessment would be much lower. This of course has a few folks insisting that the tax may actually be fair. That stated, those who attend the wealthier schools would insist they do not consume a larger portion of the city’s services than say students from a school where tuition was much lower.

The mayor has hired Joseph C. Bright, former chief counsel to the state Department of Revenue, to help pursue the 1 percent levy on tuition. Bright is on record as stating that the city will win the necessary court battle to have the tax in place for 2011.

However, one State Representative Paul Costa has announced plans to introduce a bill to put an end to the tuition tax proposal.

A Downer for Pittsburgh Students?

The levy would certainly be a major issue if Pittsburgh were the only city to institute such a tax. Seemingly, fewer students would enroll in a Pittsburgh college if such a tax were in place.

However, Inside Higher Ed has noted that Pittsburgh is not alone in discussing the idea, citing recent discussions to tax revenues from higher-education institutions in Boston, Providence, and Berkeley.

As the battle moves forward, we can be certain that the rest of the nation will be watching very closely. And we would suspect more than a few city officials across our great land, jealous of how easily colleges pass hikes onto students, could immediately move forward with proposals of their own should the concept be enacted in Pittsburgh.

A college degree can be affordable

Justin Pope, writing for the Associated Press, pulled no punches regarding the ongoing increase in college tuition for 2009-10. With costs rising anywhere from 4.4 percent at private schools to 7.3 at community colleges, Pope stipulated that colleges were handling the recent recession by simply passing “much of the burden of their own financial problems on to recession-battered students and parents.”

Those ever-increasing costs, consistently higher than the rates of inflation, have a number of folks questioning the value of a college degree, especially as students pile up exorbitant amounts of debt in their pursuit of a diploma. While we agree that absorbing significant debt while earning a diploma is a bad idea, we do still believe there is great value in obtaining your degree.

One only need examine the recent numbers from the economic downturn to find the necessary support for our assertion. While millions of young people are out of work, the percentage of those unemployed who have a bachelor’s degree is about half that of those without a degree.

One only need examine the recent numbers from the economic downturn to find the necessary support for our assertion. While millions of young people are out of work, the percentage of those unemployed who have a bachelor’s degree is about half that of those without a degree.

But the ultimate key is to find a way to earn that sheepskin without mortgaging your future in the process. Scholarships and grants can certainly help students on the funding side immensely, but for those with a mindset, there are a number of ways to dramatically reduce the overall costs of earning a college diploma.

Reducing College Costs

The first aspect of controlling your college costs is to simply examine the cost of tuition by school categories. Here are the numbers as reported by the College Board:

These numbers are definitely the first ones to analyze, but when looking at ways to reduce this cost, there are two critical elements to these figures.

First students must look at the cost per credit hour. When examining the published cost, students must look carefully at both the published tuition per credit hour and the latest college invention, fees that are generally listed as added costs that can raise the price burden per credit hour significantly.

Second there is the credit hour issue alone. Most degree programs require 60 hours of study for an associate’s degree and 120 for a bachelor’s. If you can reduce the number of credit hours you must pay for you can significantly reduce your cost of overall attendance.

Step One – Reducing Costs per Credit Hour

For 2009-2010, the tuition and fees at public two-year community colleges would produce a per credit hour average of about $85.00 ($2,544 in total costs divided by the average course load of 30 credits). In contrast, we see that the average cost per credit hour for in-state students would be $234 for public schools and $876.00 for private.

So the first step to controlling costs per credit hour is to examine the best way to obtain your desired degree. Simply-stated, unless you have unlimited funds for school, a well-to-do uncle or grandparent, forget about those expensive private schools.

So the first step to controlling costs per credit hour is to examine the best way to obtain your desired degree. Simply-stated, unless you have unlimited funds for school, a well-to-do uncle or grandparent, forget about those expensive private schools.

While private schools may boast of providing a better product, it is important for prospective students to understand that college is what you make of it. In fact, many of today’s top business leaders graduated from public institutions: Warren Buffett, CEO of Berkshire Hathaway attended the University of Nebraska-Lincoln. H. Lee Scott, the CEO of Wal-Mart Stores, attended Pittsburg State University in Kansas while James Sinegal, the CEO of Costco Wholesale attended San Diego City College.

Therefore, the first way to manage you college costs is to attend a public college, generally a campus of your state university system. I know: that just might not sound so exotic when you are discussing the topic with family and friends. But it is important to realize that exotic costs bigger bucks.

Second, if you truly want to minimize costs yet obtain a diploma, the most cost-effective road would be to earn your first 60 credit hours (years one and two) at a local community college, then transfer to a public state university school for your final 60 hours (years three and four). Even attending community college for one year would represent an enormous reduction in college costs.

There would no doubt need to be some initial homework to determine which community college credits would be transferable upon matriculation at a state school. You might even have to do some negotiating, but many of the mundane course requirements of any degree program could certainly be addressed at a community college. And if you find a course will not transfer, don’t take it. Save your funds for later. All total, with a little effort you could knock off more than a year’s worth of the higher-priced tuition costs.

Step Two – Reducing Credit Hour Costs

The second way to dramatically decrease your college costs is to reduce the number of credits you must pay for at the required tuition rate. There are almost an unlimited number of ways to reduce the number of credits that you must shell out funds for, but a good many of them must be accessed while you are still in high school.

For example, taking Advanced Placement courses can result in potential college credit. Such courses are often available at your local high school either by direct instruction or through the school in online format.

Students gain access to college-level curricula and upon completion of the material may take an exam to determine mastery. Passing that exam can provide college credit at a large number of colleges across the country.

Students may also take the College-Level Examination Program® (CLEP) tests in 34 different subject areas. These exams, at $72.00 per test, can provide anywhere from 3-12 credits at certain colleges at a fraction of the cost.

Today, many local colleges also offer courses to high school students in their area free of charge (referred to as early college). Again, given the cost per credit hour, students should investigate such options extensively and take advantage of what is available.

In all instances, including the possibility of seeking life experience credit for a work portfolio, the key is to do one’s homework up front. That means sitting down with college officials to review what credits the school will accept when a student does enter that respective institution.

For example, some schools will not accept AP classes whatsoever. Others will allow credit only provided students score a four or five on the exam (even though a three is considered a passing score).

While in college, another very distinct option to reducing credit-costs is referred to as the co-op or internship experience. Here again, the concept is dependent on the school one attends.

Co-op and internships provide students practical learning skills in a specific field through the use of work placements. In such programs, students may receive either pay or course credit for their time. If the experience is in your field of study, the work-related insight one gains is incredibly valid for one’s future career.

At the same time, many such experiences also offer college credit when students combine the proper reflection and academic review to the work experience. In certain instances, these experiences serve as a triple benefit, providing some cash to help pay the bills, some college credits to reduce the number that must be paid for, and even the possibility of potential job placement opportunities that can form as a result of the connections one makes while performing their service.

Reducing Miscellaneous Expenses

In addition to the tuition costs, students face a number of other related expenses while working towards that diploma. Such costs include room and board, books and supplies, and travel expenses.

The bottom line is these costs cannot be categorized as mere incidentals, certainly not when repeated over a four-year period. Once a school is chosen, tuition costs are set but students still have decisions that can greatly reduce the incidentals that accompany tuition costs.

Step Three – Eliminate the Room and Board

One way to reduce your four year college outlay is to rethink the idea of room and board. While many cringe at the thought, it is imperative that students understand the current going rate for room and board is now $8,193 at public colleges and considerably more at some private, elite schools.

Examine that number carefully – it is more than the average cost of tuition at four-year public schools. And it is more than triple the average tuition costs at a two-year community college.

Examine that number carefully – it is more than the average cost of tuition at four-year public schools. And it is more than triple the average tuition costs at a two-year community college.

Now spread that out over four years – a total of more than $30,000!

The simplest way to reduce this expense is to live at home. Such a decision becomes a possibility if you consider the community college/state university combined four-year plan we mentioned earlier. It certainly becomes viable if you consider community college for the first two years at a minimum.

If your home residence is simply too far away, you also need to carefully assess the school rates for both the housing and the meal aspects.

It could well be far cheaper to lease an apartment or house, especially if you can find others to share that cost.

In regards to meals, most school plans represent a significant cost per meal. In addition, missed meals seldom produce anything in the way of refunds if you do not access them. So when purchasing any meal plan, be sure it is a plan you will access.

There is no doubt that living at home limits one of the indirect benefits of college, the activities available and the connections made on-campus. To obtain those experiences, students will have to work harder at this element. But the experiences are available to all students, even if you are not residing on campus.

Step Four – Distance Learning Courses

Once available primarily at for-profit institutions, online learning is now available at a multitude of schools including state university systems. Completing one or a number of online courses can greatly impact your miscellaneous expenses.

We noted earlier the need to take into consideration fees when calculating tuition costs. Online courses often allow students to be exempt from a number of facility and campus-related fees such as student activity, campus access and technology fees. At one Florida school that lists tuition costs as $50.00 per credit hour for in-state students, those costs move to $150.00 per credit hour when all the fees are factored in.

In addition to potentially eliminating these on-campus fees, online courses also eliminate travel expenses and room and board entirely. They also can be a key component of our final savings step.

Step Five – College in 3.5 or 3.0 Years

While tuition costs are per credit hour and programs mandate a specific number of credits, miscellaneous expenses occur each semester. So one of the simplest ways to reduce total outlays is to reduce the number of semesters you are at school.

That reduction can of course come from the aforementioned reduction of credits needed. It is for this reason that AP courses, CLEP tests, Co-Op programs and Internships compound your savings, reducing costs at both levels.

But it can also come from taking additional courses each semester. Taking one extra course, either via online methods or simply taking another traditional class, for just five semesters will reduce your program from 4 to 3.5 years. Taking two online courses each summer and one extra traditional class each semester could reduce your college program to 3 years. Prerequisites can make this a challenge but with a little effort you can reduce the standard four-year program.

But it can also come from taking additional courses each semester. Taking one extra course, either via online methods or simply taking another traditional class, for just five semesters will reduce your program from 4 to 3.5 years. Taking two online courses each summer and one extra traditional class each semester could reduce your college program to 3 years. Prerequisites can make this a challenge but with a little effort you can reduce the standard four-year program.

Remember, such steps would carry tuition costs per credit hour, but they would greatly reduce the costs of room and board and those incidental traveling expenses associated with attending school.

Control Your Expenses and Earn Your Degree

While costs are growing substantially, it is important for students to know that out-of-pocket costs have trended down in recent years. In fact, while tuition and fees have risen as much as 20% since 2004, the average net price of college has dropped over the last few years.

The reason is the greater availability of grants, financial assistance and tax benefits.

Of course such developments make it all the more enticing to consider our steps to cutting the costs of college. According to a recent Time article, the increased aid development means that the “average student at a two-year college or university pays nothing in tuition and fees and collects about $500 toward living expenses.”

Of course, marketing is what drives the business world – if you package your product well enough, people will seek to acquire that product at all costs.

Generally speaking, all colleges have taken advantage of this concept. But some, specifically those elite private schools, have done so to the extreme.

The result is far too many students are being enticed, taking on ridiculous levels of debt as they attempt to obtain a diploma from a school they simply cannot afford. It is time that students, as well as their parents, went back to the old school adage, finding a quality product at a price they can afford.

With a little work and a certain level of sacrifice, students can earn that coveted diploma without mortgaging their entire future in the process.

When it comes to graduation events, most of the media focus the past couple of weeks has been on President Obama’s appearance at Notre Dame. The decision of school officials to invite the president to deliver the commencement address and award him an honorary degree was clearly not sitting well with many Catholics.

Given the president’s views on abortion, protesters have been reportedly out in great numbers. In addition, one person set to be honored offered the greatest of protests as she opted to decline a prestigious award.

Less Media Coverage

Lost amidst the hoopla was a mind-numbing story from another prestigious college, Morehouse in Atlanta, Georgia. In yet another of those situations where the term justice seems to have totally taken a hiatus, about 500 students were set to graduate without such protests.

This despite the fact that one perpetrator, Joshua Brandon Norris, was graduating and his victim, Rashad Johnson was not.

The back story represents one of the more troubling tales we have read about in years. Norris was graduating despite the fact that he had shot Johnson three times.

The back story represents one of the more troubling tales we have read about in years. Norris was graduating despite the fact that he had shot Johnson three times.

That’s correct. Norris had pulled a gun on Johnson in an altercation outside a night club in 2007. A scuffle ensued and Norris shot Johnson three times.

The Plea Deal

Facing one count of aggravated assault with a deadly weapon and second count for possession of a firearm during the commission of a felony, Norris attended a court hearing in January. There he was offered the plea deal by the prosecutor.

Norris pleaded no contest to the first count and the second charge was dropped. He ultimately received six years of probation, a $1,000 fine and 240 hours of community service.

Somehow, the incredible plea deal was also accepted by the presiding judge.

And since he avoided any jail time (he faced up to 20 years), he was able to remain in school to complete his degree. In fact, the plea deal mandated that he remain in college and complete his college degree.

Not a School Issue

Understandably, Johnson and his family were astonished to learn of the deal. Johnson, one bullet still in his left leg, had left Atlanta and gone home to California to be with his mom and to recover from his injuries.

Fahizah Johnson, the victim’s mom, took issue with the school.

“I am so disappointed because Morehouse has been an institution in my family for three generations,” she told CNN. “This guy shot my son three times, and he’s still in school? He’s still a student with other students?”

While CNN also seems to take exception to the actions of Morehouse, the school is not at fault. The incident took place off school grounds and the legal verdict essentially mandated that Norris attend school.

While CNN also seems to take exception to the actions of Morehouse, the school is not at fault. The incident took place off school grounds and the legal verdict essentially mandated that Norris attend school.

Therefore, there was simply no recourse for the school. Refusing to let Norris return to school would not have been legally supportable regardless of the actions he took.

The issue was an appalling set of decisions by the prosecutor in the case.

No Longer a Morehouse Man

According to CNN the prosecutor of the case has since resigned. His boss insists he would have been fired had he not quit.

Little has been said about the judge’s role.

The one step Johnson can take is to separate himself from the school and the city. Despite the school being a longstanding family tradition, Johnson has done just that.

He is now attending Sacramento City College and plans to attend law school after he graduates in 2011.

High school students looking to learn more about the college application, admissions and choice process have a great upcoming opportunity next month.

CollegeWeekLive, the world’s biggest virtual college fair, has been set for March 25th and 26th. Featuring more than 250 colleges and universities from around the world, the annual event is expected to see as many as 28,000 attendees.

What makes CollegeWeekLive so unique is that it offers all of the standard college fair information that students seek when attending such an event but does so in an online format. Therefore, from one’s home or school computer, a prospective college student has access to a wealth of information in a cost-effective and convenient manner.

The bi-annual event (held each November and March) offers students access to some of the top experts in the field. Virtual fair attendees can watch admissions experts speak on SAT preparation, the application essay process and or how to pay for college. Attendees will also be able to ask various questions via live chats.

The bi-annual event (held each November and March) offers students access to some of the top experts in the field. Virtual fair attendees can watch admissions experts speak on SAT preparation, the application essay process and or how to pay for college. Attendees will also be able to ask various questions via live chats.

The event will also feature virtual booths for the various colleges taking part in the fair. These booths will offer student attendees electronic brochures, videos, webinars, and podcasts related to the school. In addition, students will have the opportunity to real-time Instant Message and/or video chat with admissions counselors and students from those institutions.

As for the specific, potentially-valuable presentations for students March 25th offers:

On the second day, March 26th, scheduled topics and presenters include:

On the second day, March 26th, scheduled topics and presenters include:

More details on the proposed agenda as well as relevant links to some of the presenters are available on the CollegeWeekLive agenda page.

Though the program should be extremely worthwhile, as an added incentive to folks, College WeekLive will be giving away a brand new 13-inch aluminum MacBook to one lucky attendee of the fair! . There is a video contest and the chance to win a $2,500 scholarship to the college of your choice.

And if you attended the November CollegeWeekLive and are still a current high school student, you can also complete a survey that will make you eligible to win an iPod Touch or a $300 donation to the charity of your choice. High school seniors will find the link to their survey here while underclassmen will find a separate survey at this location.

In our prior post, we took students on a walk through some key components of personal finance. Our focus was on “good” debt (loans for college) versus “bad” debt (credit card debt) and what loans to consider, all with the idea of minimizing the debt students accrue while in college.

Today we spend some time with Kai Davis, a senior at the University of Oregon, who will graduate this spring with zero debt. Majoring in Economics and minoring in Business Administration, the Eugene, Oregon native offers readers some great insight into how to manage one’s personal finances.

Today we spend some time with Kai Davis, a senior at the University of Oregon, who will graduate this spring with zero debt. Majoring in Economics and minoring in Business Administration, the Eugene, Oregon native offers readers some great insight into how to manage one’s personal finances.

To provide students a thorough look at how Kai has managed to earn a degree debt-free, we present our discussion with him in question and answer format.

As a freshman, did you make it a goal to graduate with zero debt?

No, it wasn’t ever a plan, but I was able to achieve it. I’ve always felt that having a smaller goal like minimizing my debt would be better than a hard and fast rule of no debt. I’ve found that I’ve made the biggest impact on my savings when I’ve adopted a few small rules. I only carry a credit card with me to earn rewards points and fill up my gas tank (I earn 5% back when I use my Chase Visa at a BP gas station). Instead I carry a small amount of cash with me. When I have the impulse to make a larger purchase I wait a few days, assess the need, check my budget, and see if I can afford it. I always want to make my purchase fully aware of costs beyond the price tag.

I think that understanding how to manage your money intelligently and aggressively is the most important skill that students can leave college with. A degree shows that you have the drive, intelligence, and ambition to complete 4 years of course work. It doesn’t give you a job in that field or even the desire for a job in that field. But understanding how to manage your finances is a skill that stays with you for life.

I think that understanding how to manage your money intelligently and aggressively is the most important skill that students can leave college with. A degree shows that you have the drive, intelligence, and ambition to complete 4 years of course work. It doesn’t give you a job in that field or even the desire for a job in that field. But understanding how to manage your finances is a skill that stays with you for life.

So, graduating without debt isn’t the skill to focus on. Graduating with the ability to understand personal finance is.

Everyone talks about the rising costs of college and how students today have to borrow money to be able to pay for school. How have you been able to graduate with no personal debt?

I was already planning on attending the University of Oregon due to its strong business program. I was able to save quite a bit of money by living at home for the first 3 years of college. I’ve worked 20-30 hours each week throughout college, either at work-study jobs or on start-ups with friends. I’ve found that spending a lot of time working during college doesn’t have to come at the cost of academic success. Rather, spending a good amount of time working during college has given me the ability to triage assignments by importance and complete my academic work in the minimum amount of time.

So your choice of school was critical to your current situation?

No, not at all. I’m lucky that the University of Oregon offered a strong Business Administration major and is an in-state school, so tuition was cheaper, but I’m fairly sure that any industrious student can manage their finances well in college if they take the time to learn the system.

Are there any other steps you have taken to earn additional money?

I’ve always worked on campus in work-study jobs. Its great for networking, learning new skills, and earning money while in college. I’ve also taken recent aggressive steps to manage my money by taking advantage of high interest savings and checking accounts. I switched from a bank paying me 1/10th of a percent interest annually to a bank paying 3.8% annually. If you’re committed to saving, the money quickly ads up.

Can you talk a little bit about credit cards and how you have managed to remain on top of credit card debt?

As a college student you’re existing on a small budget and lines of credit from the school and banks. Let’s say you spend your budget quicker than you anticipated and are left with only your credit card for the month. Every purchase you make on the credit card ends up costing you more to pay it back. I’m not saying don’t make purchases on your credit card – I often do – but be mindful of how long it will take you to pay it back. When I hit the cap on my monthly budget, the first thing I do is assess which planned purchases I can cut back on. I’d much rather go without seeing a movie than having to pay that purchase back plus interest. While seeing a movie might be with $7 cash out of pocket, it isn’t worth $7 + compounded interest on a credit card.

As a college student you’re existing on a small budget and lines of credit from the school and banks. Let’s say you spend your budget quicker than you anticipated and are left with only your credit card for the month. Every purchase you make on the credit card ends up costing you more to pay it back. I’m not saying don’t make purchases on your credit card – I often do – but be mindful of how long it will take you to pay it back. When I hit the cap on my monthly budget, the first thing I do is assess which planned purchases I can cut back on. I’d much rather go without seeing a movie than having to pay that purchase back plus interest. While seeing a movie might be with $7 cash out of pocket, it isn’t worth $7 + compounded interest on a credit card.

So you would recommend that students set up a budget?

When I first moved out, I set a budget to plan out exactly how much I’d spend on food, utilities, gas, everything. I quickly found out that a budget often serves more as a sketch for spending than the actual spending. Some months I spend more on food than I anticipated, some months I spend much less. I use a budget to figure out how much I think I’ll be spending on average, and then use the final budget total for my monthly planning. If at the end of the month I’ve only spent 90% of my budget, I take a look at what I thought I’d be buying compared to what I did buy and see if I can trim my monthly estimate. More often than not I’ll treat myself with the unexpected windfall or deposit some money into savings. Establishing a budget so you have a general idea of what you’ll be spending in a month is much more important than nailing down the exact values you’ll be spending.

Have you made it a point to focus in on your credit rating?

I think understanding how to use credit is as important as your degree. A horrible credit rating can harm you for a few years, but it doesn’t have to be the end of the world if you rebuild your rating. If you graduate college with bad credit, you have years to repair the credit before you start making those big purchases: a car, a house, a boat. One of my close friends graduated college without a credit rating. He was able to pay for his degree out of pocket and never bothered to open a credit card. By the time he was 26 he had a nice savings account – $50,000 or so. He decided to buy a house and let his savings appreciate there. He found a nice house at a wonderful price and went to talk to the bank about a loan and was turned down. Because he had no credit rating the bank saw him as too much of a risk and wouldn’t issue him a loan.

I think understanding how to use credit is as important as your degree. A horrible credit rating can harm you for a few years, but it doesn’t have to be the end of the world if you rebuild your rating. If you graduate college with bad credit, you have years to repair the credit before you start making those big purchases: a car, a house, a boat. One of my close friends graduated college without a credit rating. He was able to pay for his degree out of pocket and never bothered to open a credit card. By the time he was 26 he had a nice savings account – $50,000 or so. He decided to buy a house and let his savings appreciate there. He found a nice house at a wonderful price and went to talk to the bank about a loan and was turned down. Because he had no credit rating the bank saw him as too much of a risk and wouldn’t issue him a loan.

So is a credit standing as important as a degree?

Earning a degree elevates your standing in the eyes of potential employers just as a high credit rating helps you get credit to make those larger purchases. If you don’t know how to use your degree to effectively position yourself and get a job you want you won’t have as much success during your job search. Understanding how to manage a credit rating – even a bad one! – is one of the most important lessons you can learn in college.

Credit cards and student loans are not free money. Its very easy to think that you’ll just charge purchases to your credit card, make the minimum payment a few times, and be debt free in a few months, but it doesn’t work like that.

What are your thoughts about the importance of saving?

Learning to save now prevents problems later. If a student leaves college not knowing how to manage their money, how much will their lose before they learn how to save? If you leave college understanding the importance of having a check account, setting a monthly budget, eyeballing spending in certain areas relative to your income, shopping around for the highest interest rate on your accounts, and getting a credit card with rewards or cash back and paying it down quickly, you’ll be in great shape to manage your finances.

If you had the chance to offer an incoming freshman advice on personal finance, what would be the two or three things you would most emphasize with him or her?

I’d let them know that they don’t need to lose sleep over their finances. Yes, its an important thing to manage, but if you’re smart about paying your bills and keep to a schedule you’ll be fine. College is stressful enough without worrying that you won’t have enough liquidity come graduation. Take college one day at a time, try to avoid using a credit card unless it’s a purchase you know you can afford to pay off over time, and stay happy. At the end of the day, managing finances intelligently isn’t something you have to do perfectly, but just taking the time to read the fine print and understanding how to save and spend intelligently will make a large difference.

Flickr photos courtesy of Andres Rueda, TheTruthAbout and Eliane.

In today’s tough economic times, state universities are receiving a more thorough look from students who are searching for a quality program at an affordable price.

If you are one of the individuals looking at this option, one concern could be the sheer physical size of the school and the equally large numbers of students on state campuses. However, even if you are thinking of a small liberal arts college option, you might be surprised to learn that such focused study is likely available at your state university in the form of an Honors College.

James Madison Honors College

Featuring numerous study abroad programs and dual major options, James Madison Honors College first year students follow a common curriculum including two Madison courses: a year-long Writing course and a yearlong introductory course on Public Affairs. Under the auspices of Michigan State University, Madison offers students courses with as few as eight students and major options such as International Relations, Political Theory and Constitutional Democracy, Social Relations, and Comparative Cultures and Politics.

However, students attending James Madison utilize the same admissions procedures and pay the same costs as students attending Michigan State University. Still the school has featured a number of Rhodes, Marshall, Truman and Fulbright Scholars and graduates seeking a higher degree at such prestigious institutions as Harvard, Yale, the University of Chicago, Stanford, Georgetown, Cornell, Columbia, Duke, and the London School of Economics.

However, students attending James Madison utilize the same admissions procedures and pay the same costs as students attending Michigan State University. Still the school has featured a number of Rhodes, Marshall, Truman and Fulbright Scholars and graduates seeking a higher degree at such prestigious institutions as Harvard, Yale, the University of Chicago, Stanford, Georgetown, Cornell, Columbia, Duke, and the London School of Economics.

Lauren E. Youngdahl, a 2004 graduate of the James Madison Honors College, indicates that the choice of JM represented a chance to experience the best college atmosphere possible.

“The appeal of James Madison was it was a ‘small’ college within a ‘big’ university,” explains Youngdahl. “So I could have, in my opinion, the best of both worlds.”

Her desire for a strong liberal arts background, one that focused on analytical thinking and writing was a key factor in her selection of James Madison.

From the small class sizes to the highly esteemed faculty members who are experts in their fields (no TA’s), the program delivered. She also noted the impact of high expectations of the professors regarding student work. Adding to the challenges were highly-motivated classmates, individuals who also pushed the work standards.

“I quickly learned there was no ‘skating’ by,” states Youngdahl. “And hard work was given a new definition.”

For her studies, Youngdahl was able to pursue several interests.

“I had interest in the International Relations major,” she explains. “I paired that with a Marketing degree from the Eli Broad Business School, something that was not available in any other program at MSU.”

Two other critical components of the program, the field experience and senior thesis also were key for the graduate.

“I played golf at MSU, so the best way to accommodate both my academics and athletics was to work as the Assistant Tournament Director for the Golf Association of Michigan,” states Youngdahl of her field experience. “I would say a majority of my classmates did internships with legislators, attorneys, etc. – which many of them then became.”

“And, my senior year I had a class that was dedicated solely to writing a thesis. The subject was on the evolution of Asia as a world leader; and I did my paper on the Japanese automakers and their rise to success in the United States.”

“And, my senior year I had a class that was dedicated solely to writing a thesis. The subject was on the evolution of Asia as a world leader; and I did my paper on the Japanese automakers and their rise to success in the United States.”

The Honors College at the University of Maine

The Honors Program at the University of Maine is one of the oldest in the United States, having begun in the early 1930s within the College of Arts and Sciences. At that time, there were believed to be no more than a half a dozen such programs for undergraduates in the country.

Becoming a full-fledged college in 2002, The Honors College at the University of Maine is home to approximately 650 students. As with James Madison, its smallness is demonstrated by a fundamental commitment to investigate diverse academic areas and challenge students in a supportive intellectual environment, using a process that seeks always to engage fellow students and enthusiastic, distinguished faculty in thoughtful, provocative discussions.

The program features first- and second-year preceptorials, third-year tutorials, and like Madison culminates with a thesis. Its students also demonstrate a lengthy track record of success, being named Cooke Fellows along with Goldwater, Udall, and Smith Scholars.

Rachel Groenhout, now a graduate student in the Netherlands offers similar thoughts regarding her Honors College experience at the University of Maine in Orono right down to the reading and writing focus.

“I was invited to the Honors College at my University in the summer before freshman year,” explains the 2004 graduate. “I decided to give it a try because I would be able to take Honors Courses that would satisfy general education requirements that might otherwise be done through College English, Psychology, etc.

“The special Honors Sections featured a small class size (about 15 students) and a more active student experience: reading, discussing in class and weekly or monthly papers,” she adds. “This appealed to me far more than attending class in a lecture hall and only studying for a midterm and a final exam without doing anything in between.”

Similar expectations at Maine also had students completing some type of thesis senior year to earn their honors degree. The French major presented her research by authoring the work in that language.

“This was unquestionably the formative experience of my undergraduate career. For students going on to grad school, completing a first thesis with the supervision and the support of the Honors College staff is the ultimate preparation for more autonomous research work in graduate school.”

However, Groenhout insists those students with no initial interest in graduate study will also receive enormous benefit from the experiences.

“For those who don’t go on to graduate school, you’ll still have the satisfaction of having once written an academic publication. My master thesis is underway at the moment…and will probably be better than my Honors thesis…but I think no other thesis or dissertation will ever capture my heart and soul the way that the first one did.”

Groenhout offers one other caveat that students may well want to consider.

“In a time when more and more people are graduating from college, and grades are notoriously inflated, having completed an Honors degree gives your transcript and resume a little something extra,” she notes. “Whether you do it for personal satisfaction or to remain competitive on the job market, Honors is a win-win opportunity.”

The Economic Factor

Professor Charlie Slavin, the Dean of the Maine Honors College, indicates that interest is up in the college. However, he is not certain that all of the increase comes because of the fiscal issues facing students currently.

Professor Charlie Slavin, the Dean of the Maine Honors College, indicates that interest is up in the college. However, he is not certain that all of the increase comes because of the fiscal issues facing students currently.

“As for now, it’s hard to say,” states Slavin. “We seem to have had a great deal of interest over the past year in the Honors College, but, again, there might be many reasons. We’ll probably know soon whether the current financial crisis causes precipitous changes in demand for or interest in the College.”

Still, there is little doubt that the Honors option is seen as a quality program that also carries with it great affordability. That concept is especially important to students who desire to continue on to graduate school.

“We always have anecdotal stories of students,” continues Slavin, “of those who enter with an eye already on professional schools (law, medicine). They want to be able to finish their undergraduate experience (more or less) debt-free while still having the credentials to compete well for graduate school acceptances. They know they will incur debt during that training.”

And as for why the experience of Honors College is so meaningful to so many students, Slavin offers his assessment.

“Our Honors Curriculum includes a major interdisciplinary core component that requires all of our students, regardless of their majors, to take intellectual risks,” states Slavin. “They are engaged in challenging academic inquiry outside their disciplines. I often refer to our engineers reading Plato and our artists studying the philosophy of quantum mechanics. This is the key to the honors concept.”

Honors Worthy of Consideration

In a Time magazine article from 2006, writer Nathan Thornburgh offered an assessment and rationale for considering state university honors colleges.

First, it may well be harder than ever to get into an Ivy League, but in presenting his eight strategies for kids and parents to use to find happiness beyond the ranks of the traditional elite schools, Thornburgh offers:

“Take the Honors Route – Big state schools trying to attract top students are increasingly establishing honors colleges. These schools within schools often feel like cloistered liberal-arts colleges but still have access to the superior resources of a large research university.”

For those who also love the athletic environment that a school can provide, Thornburgh adds:

“Another upside is that while you’re getting a more personalized education, you still have the chance to watch your school win a football game every once in a while.”

Slavin offers a similar assessment.

“It’s common in honors education to talk about ‘liberal arts college experience at a large university.’ I’m always a bit hesitant.

“It’s not the same, nor should it be,” insists Slavin. “Yes, there are some similarities: small classes, integrated curricula, closer personal attention. However, the real strength of our Honors College is the integration of those things with the cutting-edge research, and opportunities for students to be involved in this research, which takes place all across a major research University.”

Setting a New Trend

Cost-conscious students may want to think about bucking the elite trend, perhaps beginning a new pathway that represents a discerning consumer with a bent for both quality and value.

However, those who do so will definitely be in the minority at least for now.

“Our society still values name,” notes Slavin, a Princeton grad. “Regardless of education or credentials, there is an advantage to having a diploma with a certain name.”

Slavin notes the slow process of change.

“This is changing, more and more students from public institutions are winning major national fellowships (Rhodes, Truman, Goldwater, etc.) and getting acceptances to the most elite professional and graduate schools. But it’s hard to change people’s biases.”

Hard maybe, until you talk to students like Youngdahl and Groenhout. Listening to them, state university Honors Colleges appear to offer everything a student could want.

And most important for the cost-conscious student, they do so at a more affordable price.

75% of students receiving some form of financial aid are finding it harder to keep up with expenses. This leads them to seeking a more expensive alternative, loans from private institutions. In 2006, a huge hike in prices occurred at the four-year public schools, where tuition fees went up 6.6 percent to more than $6,000 a year.

Tuition does not include room and board but fortunately, the prices for these have been steady.

If you’re a prospective student or parent with college bound children, schools often assist with financial aid and will offer guidance on fees to pay based on your income.