College Admissions

College Admissions

Preparing for College

The Best College for You

What to Study

Applications

Education Options

Education Options

Private Universities

Public & State Universities

Community Colleges

Scholarships

Scholarships

African American Scholarships

Latino Scholarships

Native American Scholarships

Women Scholarships

College Grants

College Grants

Federal Grants

Merit Based Grants

Need Based Grants

Student Loans

Student Loans

Federal Student Loans

State Student Loans

No Co-signer Student Loans

Bad Credit Loans

Student Loan Consolidation

College Survival

College Survival

Financial Aid Tips

The Digital Student Blog

We shared with readers earlier in the week the scathing report from The Education Trust called Subprime Opportunity: The Unfulfilled Promise of For-Profit Colleges and Universities. While just the latest in a long line of criticism about for-profits, the document proved to be the most scathing rebuke of the industry to date.

Over the week we have delved deeper into the report. One aspect we wanted to review further was an area that some have held up as a shining light for the for-profit industry. We are talking about the graduation rates at two-year and less than two-year schools.

First and foremost, I agree to an extent with those who offer the mindset that attending college can be a win-win. After all, it is great to have one’s horizon’s expanded and it goes without saying that the knowledge gleaned can’t help but make a student a more productive citizen in the long run.

First and foremost, I agree to an extent with those who offer the mindset that attending college can be a win-win. After all, it is great to have one’s horizon’s expanded and it goes without saying that the knowledge gleaned can’t help but make a student a more productive citizen in the long run.

But at the same time, I am a firm believer that attending college becomes a win-win only if one earns that coveted sheepskin. After all, it is the diploma that generally provides students an opportunity to pursue better paying jobs that also carry with it those much-needed benefits.

In this single arena, the report does indicate that for-profit colleges are actually setting a pretty decent standard. According to the report, the graduation rate for associate degree programs or certificates at two-year for-profits is 60 percent. At the less than two-year for-profits, 66 percent earn a credential.

These percentages are based on completion of a program within the standard three-year time frame (as compared to six years to earn a bachelor’s degree). These completion rates are of course considerably higher than the 22-percent rate posted by community colleges.

One Big Problem

But the folks at Education Trust point out that this completion rate, while far better than the current rate of their public competitors, comes at a heavy price. The report clearly indicates that for-profits are leaving students with significant amounts of debt whether or not we are talking about bachelor’s degrees or associates.

First off, 19 percent of associate’s degree students and 3 percent of those completing a certificate at for-profits have debt loads greater than $30,000. That number is actually 25 percent more than the average debt incurred by all graduates of bachelor degree programs in America.

In contrast, only 2 percent of associate’s degree recipients and 1 percent of those students receiving a certificate at public institutions graduate with that level of debt.

But the real negative has to be the default rates of for-profit students. While college should lead to a path of higher earnings in the long run, it appears that students graduating from for-profits cannot earn enough money to pay back all the funds they have borrowed.

Sadly about 10 percent of for-profit students default on their federal loans within two years of entering repayment. Worse yet, the three-year rate of default nearly doubles to 19 percent.

These default rates are roughly twice the rates of students at public and private nonprofit colleges. In sum total, 43 percent of all federal student loan defaults come from students at for-profit schools. However, only 12 percent of college students attend for-profit schools.

Sum Total

At the bachelor’s level, for-profits have an abysmal graduation track record. At the associate and certificate level these institutions are producing better results than public community colleges.

But the high cost of programming leaves many significantly in debt. Most importantly, the high default rates reveal far too many students cannot overcome their debt burden.

Such a situation calls into question the actual value of the degree itself. It leaves us thinking that the sheepskin from these institutions is simply not worth the cost of attendance.

Having borrowed $200,000, a graduate of Northeastern University resorts to begging for help online.

One college student is receiving a great deal of publicity for her unique way of dealing with her student loan debt. In a form that one could only describe as Internet begging, 23-year-old Kelli Space has created the web site Two Hundred Thou.

The home page displays this simple explanation:

I owe over $200,000 in student loans. Please donate to the cause: together we can make these loans disappear faster than you can ask why I went to such an expensive school!

Learning What Not To Do

With current loan payments of $891 a month, Space provides us a powerful example of how naïve some college students are when it comes to borrowing for school. With payments on her federal loans set to nearly double by November of next year, the young lady now realizes her situation is hopeless unless she can find some extremely charitable souls.

With current loan payments of $891 a month, Space provides us a powerful example of how naïve some college students are when it comes to borrowing for school. With payments on her federal loans set to nearly double by November of next year, the young lady now realizes her situation is hopeless unless she can find some extremely charitable souls.

On her site she offers the simplest of explanations as to how she managed to incur $200k in debt?

Tuition and room + board for four years, along with 2 summer semesters, a 3-month stint abroad (as it is 1 of several options offered to fulfill Northeastern’s experiential education requirement), and books for approximately 3 semesters when I did not have a job at the onset. AND the interest that has accrued over the past 5 years (as interest accrues on private loans as soon as you take them out).

Space insists that she worked most of the time she attended school including her on campus work-study option. She also insists she did not receive any grants, just aid in the form of student loans. In spite of the costs of schooling and the lack of financial support, she also insists that she followed the advice of a financial advisor at the school “to explore other options” to help fund her Northeastern education “including private lenders.”

The Power of Compounding

Space provides us a great lesson in the power of compounding. On the site she reveals that her federal loans alone accrued more than $20,000 of interest during her time in school. So more than one-tenth of her debt is simply the interest on the original loans.

In addition, in her plea for help, Space also demonstrates the famous power of compounding. She notes that she would need one fairy tale donor, a very exceedingly generous soul, willing to cough up the full $200,000 to make her debt free.

But she could make the issue far more manageable if she could find just 1,000 sympathetic visitors. It would take only a modest $200 donation from each of those individuals to put an end to her debt.

But she could make the issue far more manageable if she could find just 1,000 sympathetic visitors. It would take only a modest $200 donation from each of those individuals to put an end to her debt.

She also notes that just $5 per donor would be enough if she could find 40,000 sympathetic souls and just 67 cents per person if just one of every 1,000 Americans (300,000 out of more than 300 million people) felt enough kindness to help with the young lady’s plight.

The Debt Load

In our Student’s Guide to Finance we offer some basic ways for students to determine how your loans will affect you. We offer the advice of MSN Money professionals who insist that monthly loan repayments from school should not exceed 10% of your expected earnings.

Furthermore, to be safe in determining expected repayment, experts indicate that students should project an 8% interest rate return on the amount borrowed. Under such a scenario, every $1,000 you borrow costs roughly $12 a month to repay for a 10-year loan.

Therefore the average college student who leaves school with $24,000 in debt would face a monthly payment of about $288 per month. According to the MSN experts, to be safe you would need a monthly income of $2,900 to meet the 10% threshold, or a starting salary of about $35,000.

A person accruing $50,000 in student debt would face monthly payments of over $600 and thus require a monthly salary of $6,000 and yearly earnings of $72,000.

Can you predict what Kelli Space now faces?

One Naïve Young Lady

Our quick calculation reveals that $200,000 in student loans would normally yield a monthly bill of about $2,400 and thus require a yearly salary approaching $300,000.

Yes, this young lady would need a salary of $300,000 a year despite having earned only an undergraduate degree.

Such an amount would be viable only if one could claim a graduate degree in law or medicine but would still be a challenge even for them. Nowhere on the site could we find Ms. Space’s college major, so we cannot assess what would have been a realistic amount for her to borrow.

Instead, we can only shake our head in disbelief.

And acknowledge the young lady has now likely taken the only step that might allow her to correct this incredible mistake.

But begging for funds over the Internet is not a method we can recommend others contemplate. Instead, we suggest that students educate themselves on the damage that excessive borrowing can wreck on one’s future.

As the school year heads into its second quarter, high school seniors are now beginning the process of finalizing which schools they will apply to. One aspect of this process involves what may seem like a rather arbitrary decision but it is one that students should think carefully about.

We are talking about the choice as to how many schools to apply to.

Before presenting our recommendation as to how many, let us look at the current norm as published in the 2010 State of College Admission Report.

First off, the 2010 report reveals that seventy-five percent of those students who became college freshman in the fall of 2009 applied to three or more colleges. As for the heavy hitters, nearly one out of every four students (23 percent) submitted seven or more applications.

Clearly, applying to one or two colleges would place you in a distinct minority these days. But the suggestion that everyone is now applying to at least six to ten colleges is simply not accurate either.

One good reason for limiting the total number of applications is the cost of filing one. According to the report, 90 percent of colleges had an application fee and the overall average was $39.

One good reason for limiting the total number of applications is the cost of filing one. According to the report, 90 percent of colleges had an application fee and the overall average was $39.

But larger institutions, as well as the more selective colleges, tended to have higher fees. However, 84 percent of those colleges that charged an application fee waived them for students with demonstrable financial need.

While applying to a number of schools can be expensive, the ease with which one can apply has grown exponentially. With a common application that can be filed online with the touch of a button, students may now easily apply to multiple schools.

Colleges Seek Your Application

It is important however for students to understand that colleges, in general, are actively seeking your application even if they are not actively seeking you as a potential student. In the college rankings game, it is important for schools to be able to publish data that seemingly demonstrates how sought after the school is by students.

The process works like this: a larger number of applicants is seen by outside agencies as a sign that a school is highly thought of by students. Likewise, a greater applicant pool allows a college to also sift through the many candidates to offer admission to those seen as the most worthy.

The result is that colleges can increase their selectivity rating and thus select a lower percentage of students for admittance. The increased number of applications combined with a lower percentage of acceptances works to improve a college’s ranking in those all important guides.

For that reason, colleges reach out to students for the purpose of drumming up interest in the school. Again, quoting the recent report, on average, colleges and universities spent about $524 just to recruit each applicant for Fall 2009 admission ($843 for each admitted student and $2,553 for each enrolled student). Ultimately, students need to understand that a good many people are working very hard to get an application from you.

The Number to Apply to?

While 23% percent of students currently apply to seven or more schools it is interesting to note that only 13% of students in 2000 applied to that many schools. One reason for the increase may be the concern that more students are attending college and therefore competition for openings is more of an issue.

But is also interesting to note that the acceptance rate for students in 2009 was 67%, nearly the same number (71 percent) as in 2001. That means that virtually every single applicant is accepted by at least one worthy college even if it is not the person’s first choice.

The result is that students are giving careful consideration as to where they will apply and even beginning to rethink the number as well. We read recently where there is a growing consensus that less could be more and the case of a very strong student coming up with a list of just five schools.

Those schools should include a good mix of reach, match and safety schools. And while some are still suggesting applying to between six and ten schools three reach, three match and two safety schools, we believe that identifying one or two reach schools at most, two match and two safety can give students a great deal of choice.

Five to six, maximum remains our recommendation. The key is to do your homework and determine the schools that are the best match for you.

Do not waste time applying to any school based simply on the notion that your peers are applying to eight or more. There is absolutely no sense in applying to a school that you are not 100% interested in attending no matter how easy it is to apply or how much one specific school seems to be reaching out with admissions info.

Credit card companies with excessive fees paying colleges millions for the right to access you on campus.

Over the past few weeks we have spent a great deal of time discussing the growing problem of student loan debt. Simply stated, students are borrowing far too much in the process of earning their diploma and their accumulated debt is endangering their entire future.

At the same time that loan debt is creating a heavy burden for students, another form of debt is wreaking havoc for the general public. We are talking about credit card debt, an issue for all adults including those just graduating from college.

Current data suggests that college students possess an average credit card debt of $4,100. Such a number is almost inconceivable to us, because this is not the number the highest set of borrowers owes – it is the average. With credit card interest rates for young people at astronomical levels, those accumulating such a level of debt soon find their monthly payments growing without those payments reducing their card debt.

Current data suggests that college students possess an average credit card debt of $4,100. Such a number is almost inconceivable to us, because this is not the number the highest set of borrowers owes – it is the average. With credit card interest rates for young people at astronomical levels, those accumulating such a level of debt soon find their monthly payments growing without those payments reducing their card debt.

We have long advocated that students think twice about all debt but particularly that associated with credit cards. To ensure that students don’t get in over their heads, we have advocated that they shop around and get a single card that can be used only in a true emergency. We further advise students who have charged or continue to charge any amount to pay the balance in full each and every month to avoid the exorbitant interest charges most credit card companies assess.

Resisting Temptation

Clearly, that advice has been falling off deaf ears. But then again, we can easily grasp how students get snookered given how hard card companies work to get a card into your hands.

Thanks to the Credit CARD Act of 2009 it is now possible to get a full glimpse as to how much companies are willing to spend to get students onto the debt bus. Under the Act, credit card issuers had to submit some very specific data to the Federal Reserve. That data included how much money credit card companies spent in fees to universities just so that they could set up shop on college campuses. In addition the CARD Act demanded issuers release how many new accounts were opened due to these on-campus opportunities.

Consider the data that was collected. First off, credit card issuers paid more than $83 million for the right to go on campus and thus potentially sign students up for an account. That’s correct, a total of $83 million.

According to the data collected by the Federal Reserve, a total of 17 different credit card companies issued more than one thousand college card agreements. As but just one example of the 17, Chase Bank spent over $13 million to entice new student customers. This of course does not take into account the cost of each company’s employees’ time on campus recruiting new customers.

At the same time, to get a sense as to how much these credit card companies are making off of students, this $83 million enabled card companies to sign up 53,000 new student clients. This translates to an astonishing figure: these companies spent, on average, about $1,600 for each and every student just for the right to sign these new customers up.

At the same time, to get a sense as to how much these credit card companies are making off of students, this $83 million enabled card companies to sign up 53,000 new student clients. This translates to an astonishing figure: these companies spent, on average, about $1,600 for each and every student just for the right to sign these new customers up.

Yes, these companies spent $1,600 just for the right to try to get a card in your hands. Anyone with a basic business understanding realizes that to make up these initial marketing costs, the cards offered have to be laced with fees and high interest rates. Otherwise, these companies would not spend such extraordinary sums of money just to get the chance to sign you up for card.

Their goal is simple – get a card into your hands and then start charging you excessive fees whenever you miss a payment or incredible interest rates when you are unable to pay off the loan balance immediately.

Don’t Get a Card on Campus

The thought of easy access to credit can be enticing but students need to understand that those card companies on campus are simply not the ones to consider. If you head over to CreditCardConnection.org you will see a list of those companies that Credit Card Connection warns consumers to avoid due to their unfair and unethical practices.

A single credit card to be used in emergency situations is a good idea. But not all cards are created equal – do your homework and find a card that has reasonable interest rates and minimal finance charges. Many credit unions offer a card that offers reasonable access to credit as well as a fair fee structure should you not be able to keep your monthly balance zeroed out.

The bottom line is that debt is a very bad thing and we are talking all forms, student loan and credit card. But the most insidious is credit card where card companies take advantage of unsuspecting students.

If you see one of those card companies on your local campus, you would do yourself a favor if you began walking in the other direction as fast as you can.

All federal loans set to follow the Direct Loan program format.

Lost in all the hype over the passage of the landmark health care bill was a provision in the bill to revamp the federal student loan program. The legislation will put an end to the popular FFEL Program and thus push all federal college loans into the Direct Loan format.

The FFEL and DL Programs

The Federal Family Education Loan Program (“FFEL Program” or “FFELP”) is often referred to as the federally guaranteed student loan program. In FY 2008, approximately 75% of all colleges participated in this lending option.

The Federal Family Education Loan Program (“FFEL Program” or “FFELP”) is often referred to as the federally guaranteed student loan program. In FY 2008, approximately 75% of all colleges participated in this lending option.

As opposed to the loans originating from the federal government, in the FFEL program the loan funds come from banks and other financial institutions. Because of the large number of entities offering such loans, colleges participating in the FFEL program were able to maximize borrower choice.

In addition, the FFEL program offered the same set of loan options as the Direct Loan program: Stafford, PLUS and Consolidation loans.

Funds for the William D. Ford Federal Direct Loan Program (“Direct Loans” Program or “DLP”) come directly from the US Department of Education (which gets the funds from the US Treasury). Because of the funding source, this source of aid has not experienced the same funding issues as FFELP has during the current credit crisis.

Program Differences

Critical differences have begun emerging within the two programs. First, as noted above, as the credit crisis worsened and banks tightened their lending practices, less money was available to students in the form of FFELP loans. In contrast, DLP loans remained available.

Unfortunately, the Ensuring Continued Access to Student Loans Act of 2008 (ECASLA) did not address funding issues in all loan programs, just the Stafford and PLUS loan programs. The indirect result was that consolidation loans originating after October 1, 2007 became unprofitable for FFEL program lenders. Because of that development, most of the FFELP lenders have stopped offering consolidation loans.

In contrast, consolidation loans continued to remain available from the Direct Loan program but borrowers in the FFEL program generally could only consolidate their loans by moving into the Direct Loan program.

Two other major differences tend to make the Direct Loan option a better one for students. First, the interest rate on the PLUS loan maxes out at 8.5% in the FFEL Program. For the Direct Loan program, the maximum rate tops out at 7.9% for the PLUS. However, the interest rate on the Stafford Loan is identical in both programs.

Independent analysis has revealed that parents are more likely to obtain a PLUS loan approval in the Direct Loan program than in the FFEL program. The 2007-08 National Postsecondary Student Aid Study (NPSAS) suggests that the Parent PLUS loan denial rate in the FFEL program in 2007-08 was double the Parent PLUS loan denial rate in the Direct Loan program.

Independent analysis has revealed that parents are more likely to obtain a PLUS loan approval in the Direct Loan program than in the FFEL program. The 2007-08 National Postsecondary Student Aid Study (NPSAS) suggests that the Parent PLUS loan denial rate in the FFEL program in 2007-08 was double the Parent PLUS loan denial rate in the Direct Loan program.

Lastly, the new Public Service Loan Forgiveness option is available to students only in the Direct Loan program.

Customer Service Impact for Students

On the plus side, according to the Congressional Budget Office estimates, eliminating the middleman from the loan process will save the federal government between $6 billion and $7 billion per year. Those savings are reportedly possible because the government has paid private banks billions of dollars in subsidies to encourage those institutions to loan to students.

On the negative side, the changes will result in the loss of a number of valuable agencies.

But for most college students, the major question centers upon how the legislation affects them and their families. The answer is that it will impact students according to their financial status.

An enormous increase this year in Pell grants was set to create a major shortfall in fund for many low-income students. The legislative change ensures that the Pell grant program will not only remain solvent, it will provide annual increases in the maximum grant allocation for the foreseeable future.

An enormous increase this year in Pell grants was set to create a major shortfall in fund for many low-income students. The legislative change ensures that the Pell grant program will not only remain solvent, it will provide annual increases in the maximum grant allocation for the foreseeable future.

Second, the funding level for students will be more secure. Therefore, those students who recently found loans drying up during the fiscal crisis will now know that such funds will remain available.

Lastly, the legislation will do nothing to negatively impact existing loans including private loans. But for those individuals who later qualify for the Income-Based Repayment Program, the capped rate will drop from 15% to 10% of discretionary income and shorten the repayment window from 25 to 20 years.

In actuality, the greatest impact will be felt with the school’s financial aid officers. One critical outcome is that those individuals will no longer play a role in which private lenders are used to originate those loans for students.

But of course, at this point, only the House has approved the bill. The Senate is scheduled to take up the bill later in the week.

As Thanksgiving approaches and the first semester enters its final weeks, now is the appropriate time for freshmen to take stock of their choice of a college. If you were like virtually every other student in America, you began the year experiencing some real feelings of homesickness. Not only did you miss the high school friends you no longer get to see, you found yourself missing that family dinner table.

Many a day you felt like an outsider. Not only was everyone older than you, they all seemed to know the routines you were still trying to figure out. Even so, you all faced yet another challenge, living with a complete stranger in a tiny dorm room that had you feeling that your privacy had been compromised forever.

Many a day you felt like an outsider. Not only was everyone older than you, they all seemed to know the routines you were still trying to figure out. Even so, you all faced yet another challenge, living with a complete stranger in a tiny dorm room that had you feeling that your privacy had been compromised forever.

All of it only added layer upon layer of stress to the significant academic demands of your classes.

But by now, if you are like most college students, you find you have picked the perfect place. You have had the chance to meet many wonderful new friends and adapted to the give and take of living with another student. Though you still feel a sense of wanting to communicate with former friends and family, you now have ample social opportunities and a host of people that help lessen the emotional tugs of those you have not been able to see.

Most importantly, you have a sense of the academic rigor and how to meet the educational demands being placed upon you. In sum total, if you are the typical student, you have been able to carve out a new place that should now feel like home.

Whereas in September and early October we would counsel patience, as Thanksgiving approaches if you have found that you still have not made any friends or are not feeling positive about college, it could well be that you did not select the right school for you. Here are five warning signs you may have picked the wrong college.

Feeling totally Out of Place Socially

Do you continue to feel out of place socially? Have you had real difficulty finding at least two other students who match your values and view regarding college?

Does your school seem to be a steady stream of parties with few folks focused in on academics? Or, does the atmosphere appear too stuffy and intense as everyone seems to hunker down and study incessantly?

Perhaps you have not found a single classmate that shares your particular religious views or who shares your interests in environmental or political issues. Maybe you feel out of place wearing Walmart jeans amongst folks who see JCrew as cheap fashion.

While it is natural to feel alone the first month or two at school, by now you should have come across a few individuals that match your values. If you truly have made a strong effort to find classmates yet still feel like an outsider, you may well have selected the wrong school for you.

The Wrong Physical Location

Were you concerned that your choice of college was going to get in the way of the friendships you began developing in early childhood? Or worse yet, did you select your school based on your desire to still be able to see a certain boy or girl?

Were you concerned that your choice of college was going to get in the way of the friendships you began developing in early childhood? Or worse yet, did you select your school based on your desire to still be able to see a certain boy or girl?

And because of those concerns, did you choose your school simply to be closer to home only now to find your high school friends showing up on campus every weekend or worse yet stopping by during the week?

Perhaps it was the opposite, in a desire to be on your own, you chose a place that put some serious miles between you and your former life. But perhaps you chose such a distance that as Thanksgiving approaches you are now stuck on campus with not enough money to fly home and too far to hop in a car and ride.

Experts advise students to be sure they choose their school based on the programs it offers and their personal academic interests. If instead you selected your school based on a specific location you may well find yourself regretting that choice.

Safety

To be at your best facing the rigors of a college education, you positively must feel safe on your college campus. If for any reason you find yourself with such concerns then you likely have made the wrong choice of school.

For different students, feeling afraid comes from very different elements. Those used to an urban lifestyle may well be uncomfortable at night walking on a rural campus where there are far fewer lights and fewer people around. For those students, the rural setting appears devoid of a truly well lit path to follow at night.

In contrast, those who have grown up in a rural setting may find the noise and the hub bub of people constantly milling around very intimidating. Such a feeling can be doubly strong when combined with an urban feel where many of the people you encounter are not necessarily fellow students.

The bottom line is your campus must feel safe to you – that includes your dorm and the walkways to and from all class buildings. And while it is easy to say buck up, fears are not easily overcome, no matter how hard you try to rationalize them.

If for some reason you constantly find yourself confined to your dorm room in fear of what lies beyond, then you most definitely have chosen the wrong college for you.

Co-curricular Activities

Did you select your school based on a desire to be part of a specific athletic team or club? If so, are you finding the activity to be everything you thought it would be?

Or is the commitment much larger than you expected? Is the focus solely on winning? Is the coach or moderator unwilling to modify practice or the scheduled meeting expectations in light of your academic workload?

Are you enjoying the activity but finding the academic setting ridiculously easy or boring? Do your professors inspire you and are you learning new skills? Or do you find yourself tolerating your academics and focusing solely on the co-curricular?

If any of these options describes your setting you may well have chosen the wrong school. Remember, the goal is to obtain a diploma and position oneself for career options.

A great co-curricular program cannot make up for a lackluster academic experience – worse yet, your co-curricular program should not interfere with your fundamental reason for attending college in the first place.

Work Is Too Easy

While at first thought it may seem better to be finding the work too easy than too hard, the harsh reality is that you are paying significant amounts of money for the opportunity to learn new things.

While at first thought it may seem better to be finding the work too easy than too hard, the harsh reality is that you are paying significant amounts of money for the opportunity to learn new things.

Perhaps you were just unlucky and got a weak professor that knows that placing demands on students also means more work for him or her.

Or maybe you have chosen the wrong level of courses and the wrong area of focus for you.

However, if you are taking five courses and you find that not one of the five is challenging you or providing you with new learning, this also reflects on the school and the assignment of courses.

Most students find the college workload adjustment significant, so challenging that they feel overwhelmed at first. That is the normal setting for students – so if you find you are coasting through your first semester you should definitely take stock of your program choice, your choice of courses, and your selection of a college.

Transferring Out

Again, after two plus months of effort you should now be settling into the place you are excited about spending the remainder of this year and the next three as well. If that is not the case, then you may well have made the wrong choice of school for you.

If you are beginning to feel as if the college you chose just isn’t right for you, the last thing you should do is pack up and go home. Instead, you need to focus in on the academic task ahead to ensure you complete the semester in good standing. There is simply too much money invested to simply give up.

In fact, most experts insist you should proceed onward to your second semester even as you begin looking at alternatives. The rationale is simple, if you stay on and prove you can handle the academics, you will be able to demonstrate that you are not simply a weak student looking for an easier place to attend school.

Those same experts insist you should stay involved in your respective activities and perhaps even seek out new ones. With solid grades and a demonstrated commitment to the task at hand, you will be more able to successfully pursue an option at another school.

Remember, the goal will be to transfer to a school that you desire, not one that will simply accept you. The fact of the matter is if you cut and run, you may well eliminate any chance of transferring to your chosen alternative.

As difficult as it may be to take, each day it seems the economic news is worse than that of the day before. This past week the jobless rate in America hit an astonishing 8.1%.

Yet as bad as that sounds, predictions are that the number will continue to grow for the foreseeable future, perhaps reaching double figures by late spring or early summer.

The data also indicates that the impact of the economy has hit young people the hardest. According to Bob Herbert of the NY Times, those being hit the hardest and therefore, those who will subsequently have the most difficult time recovering are America’s young workers.

In his column on February 28th, Hebert noted that “nearly 2.2 million young people, ages 16 through 29, have already lost their jobs in this recession. This follows an already steep decline in employment opportunities for young workers over the past several years.”

In his column on February 28th, Hebert noted that “nearly 2.2 million young people, ages 16 through 29, have already lost their jobs in this recession. This follows an already steep decline in employment opportunities for young workers over the past several years.”

A College Education

Nearly 2 million people have lost jobs in just three months and the layoffs have come in all arenas: blue-collar, white-collar, highly educated and not.

With 4.4 million lost jobs during the entire downturn and another 12.5 million people searching for work, no age group or industry has been spared. And yes, recent data reveals that the “jobless rate for college graduates has hit its highest point on record, just like the rate for people lacking high school diplomas.”

But those wondering about the wisdom of a college degree, particularly given the cost of a diploma in such uncertain times, it is imperative that you look further into the numbers being released.

Because, while the unemployment rate recently topped 8.1% for all Americans, the jobless rate for people with bachelor’s degrees is still barely half that figure, 4.1 percent. And as far as the high school dropout population, the current unemployment rate stands 50 percent higher for that group than the national average, a whopping 12.6 percent.

Because, while the unemployment rate recently topped 8.1% for all Americans, the jobless rate for people with bachelor’s degrees is still barely half that figure, 4.1 percent. And as far as the high school dropout population, the current unemployment rate stands 50 percent higher for that group than the national average, a whopping 12.6 percent.

Tough Times

Article after article reveals the current downtrend as one of the worst in American history. Though we are still a long way from matching the numbers associated with the great depression, to find a situation rivaling today’s you have to go back nearly thirty years, to the early 1980s.

Make no mistake, these are exceedingly tough times and the downward economic spiral is affecting people from all walks of life, including the college-educated.

But with tough times come great lessons. And one of those fundamental lessons is that those individuals who have taken education seriously are less vulnerable during difficult economic periods.

Flickr photos courtesy of LGagnon and a.saliga.

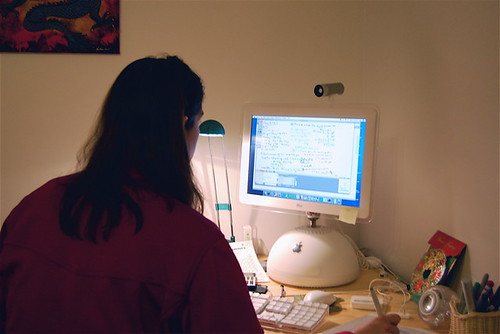

There is little doubt that online courses and degrees offer exceptional convenience and value. The ability to study from your location of choice at a time most convenient to you certainly offers both cost savings and greater flexibility.

However, anyone seeking an education should be equally concerned with the quality of course offerings. If you are not careful, greater convenience and frugality could result in a “you get what you pay for” educational program.

With online programming here to stay, it is imperative that students understand what to look for when considering such a study option. Quality web-based programs are defined by specific characteristics – students looking at online courses and degree options should look to see if the following attributes are present.

With online programming here to stay, it is imperative that students understand what to look for when considering such a study option. Quality web-based programs are defined by specific characteristics – students looking at online courses and degree options should look to see if the following attributes are present.

Online Education Demands a Different Approach

The process of creating an effective and engaging online learning environment is different from that of traditional education. For example, an online class constructed simply of taped 45-50 minute lectures, a list of readings, or an uploaded curriculum (followed by online tests or quizzes) shows little consideration for the student or the learning process.

Rather than merely making content available for access, online instruction should be designed to engage learners in a variety of activities. Quality online instructors create various forms of interaction ensuring that mastery of course material is a result of doing rather than simply by reading or listening.

In formal terms, online courses should do much more than make content available – these courses should create a true learning environment.

At the same time, an excellent online course will offer multiple pathways through the material depending on a student’s prior experiences and knowledge. Those with little or no prior knowledge must be provided potential additional resources to help them gain the necessary background. However, for those with the basic information, those materials should not be mandatory reading or made into busy work.

Here again, these pathways must be designed for easy delivery within the online medium. The course should engage and immerse the student in the learning experience even as it puts students in charge of their own learning.

Use of Multiple Technologies

The beauty of the web now is the number of different technologies available for professors. The best online courses take advantage of the many options available.

With blogs, wikis, instant messaging, podcasts and streaming video, information can be presented and collected in many different ways. Even chat rooms, once designed as text-only now can provide student participants audio and video signals.

Because of all the new hardware available, the best online courses will offer options for the many mobile devices available. Being able to access course materials via iPods, pdas, and smart phones through wireless hot spots can be a great help to some students but they may not be viable for others.

Because of all the new hardware available, the best online courses will offer options for the many mobile devices available. Being able to access course materials via iPods, pdas, and smart phones through wireless hot spots can be a great help to some students but they may not be viable for others.

Again, the best online courses will incorporate multiple options for students ready to implement those techniques. However, the course will not be designed to feature bells and whistles unless those aspects enhance learning potential. In simplest terms, technology should be chosen according to how it will help meet the specific learning objectives of a course.

Great Online Courses Feature Caring and Competent Teachers

Ultimately, a quality online program is similar to that of a traditional option in that the course is taught by an excellent instructor. The attributes that are identical in both settings are teachers that are subject-competent, highly skilled and diligent.

Other general attributes include a great sense of humor and high, clearly articulated expectations. Competent teachers also are able to provide clarity when material becomes more challenging or ambiguous.

Lastly, these instructors willingly provide effective feedback to students. They are able to reinforce accomplishments through proper praise yet provide fair and constructive feedback when students fall short of expectations.

Where online teachers differ from those in the traditional setting is their ability to instruct in their respective environment. Online teachers must be masters of the technology being used and understand the different methodologies associated with instruction in an online environment.

Where online teachers differ from those in the traditional setting is their ability to instruct in their respective environment. Online teachers must be masters of the technology being used and understand the different methodologies associated with instruction in an online environment.

Therefore, excellence in online education requires more than a caring educator with subject expertise. They must be adept at the various forms of technology utilized within the course and the process for making the content come alive in the online environment.

A Sense of Community Is Present

A definitive weakness of online programming is the lack of face-to-face contact with the professor and fellow classmates. An inability to interact with others can create a class that feels impersonal and where students feel alone.

In contrast, one of the most positive aspects of traditional education is the sense of community that can be created. Therefore, it is imperative that online courses work to create a sense of community within the online environment.

Without a connection to the professor or other students, participants are unable to arrive at a complete understanding of the content. Therefore online instructors must work to develop a social presence.

Whatever formats are to be used, blogs, chat rooms or email, the best online teachers understand that this sense of community will not happen by chance. To facilitate such an environment, great instructors work to include collaborative learning projects and small group activities where students are connected through the technology provided.

Whatever formats are to be used, blogs, chat rooms or email, the best online teachers understand that this sense of community will not happen by chance. To facilitate such an environment, great instructors work to include collaborative learning projects and small group activities where students are connected through the technology provided.

And as mentioned before, the instructor will utilize all forms of technology, including the use of audio and video whenever it is appropriate. Ultimately, a quality course will, at least at times, be more than just the written word.

An Excellent Web-Interface

The ability to easily access all the key material elements of a course is also critical. The course design, especially those technologies to enhance learning and community, must be easily accessible and working with minimal interruption.

The simple theory is that a great web-interface cannot make up for a poor teacher or a lackluster course. But a poor interface can ultimately ruin an excellent class.

Access to a clear study guide must be available at all times. A list of FAQs prominently posted can serve to help students get answers to common questions instantaneously.

Access to a clear study guide must be available at all times. A list of FAQs prominently posted can serve to help students get answers to common questions instantaneously.

Most importantly, the interface should be intuitive and offer multiple points of entry to relevant material whenever possible.

Summary Expectations

Online classes are very different than those delivered in the traditional classroom setting. They are taught by caring teachers who are as tech-savvy as they are content experts and therefore understand that online learning demands a different approach.

These individuals then utilize the technology available to ensure an interactive learning environment that creates a strong sense of community within the course. All the while, they understand the importance of timely and relevant feedback for students.

Most importantly the course is offered with an intuitive and high-functioning web-interface.

Online programming is definitely here to stay. Such programming is convenient and often-times less expensive than traditional classes.

However, quality should also be of utmost importance. Students looking at online courses and degree options owe it to themselves to hold these programs up against these fundamental standards.

If a school consistently offers courses that fail to meet one or more of these attributes then it is time to look to another study option.

Flickr photos courtesy of Sarah M Stewart, Dan H, mcwetboy, whurleyvision and mrplough.

Students looking for additional test prep practice options can now turn to two additional venues, a video game from the Princeton Review and a free online site called VerbaLearn.

Another SAT Prep Game Option

Joining Kaplan’s FutureU on the video game market is Princeton Review’s My SAT Coach. As with the Kaplan version from Aspyr Media, the Princeton version seeks to bring SAT preparation to the video game market.

The Princeton option features the gaming folks at Ubisoft. Designed to be an enjoyable way for test preparation, the game seeks to help students learn the key skills for tackling all of the different subsections of the SAT test. The game also provides feedback so students can see the overall progress they have made through game play.

The Princeton option features the gaming folks at Ubisoft. Designed to be an enjoyable way for test preparation, the game seeks to help students learn the key skills for tackling all of the different subsections of the SAT test. The game also provides feedback so students can see the overall progress they have made through game play.

The Princeton game also seeks to involve students in “a series of mini-games that will help you increase your level of judgment, confidence and time management. Learn about helpful methods and mental approaches to reduce stress and ensure you are physically and mentally prepared.”

Unfortunately, we could not find any reviews confirming the enjoyability aspect of the game. But with every piece of data indicating that practicing for the exam does in fact lead to better scores, you may want to give the game a go.

The new game from Ubisoft offers timed testing options but unlike FutureU which is also available for download to a PC or Mac computer, My SAT Coach is available only for Ninetendo DS (cost, $29.99).

A General Vocabulary Builder

Going one step better, at least in vocabulary preparation, is the new site VerbaLearn. Instead of focusing on SAT prep, this site is designed for “polishing your lexicon” and would be helpful in preparing for any of the nationally normed tests, the SAT, ACT, and/or GRE.

Most importantly, the game is free, meaning there is no reason not to give it a try.

The online site offers you the ability to customize your vocabulary list and customize MP3 options that feature the words on your list. That means that though the site is based online, you have the option to download podcasts to iTunes or any application of choice, and take them with you to review while on the subway or bus.

The site features a simple demonstration video that explains the basic workings of the site and a suggested feature called VerbaLearn2Earn to help create additional incentives for the vocabulary building process.