Borrowing Money for College – Why You Need to Think Twice Before Signing on the Bottom Line

We recently reported on an extremely negative piece of news for college students: today, the debt load from student loans has actually surpassed that of credit card.

For too long we have been a nation of borrowers. That culture has created a disastrous situation for many Americans who borrowed too much for their homes, placed too much debt on their credit cards, and as we now know, borrowed too much money to attend college.

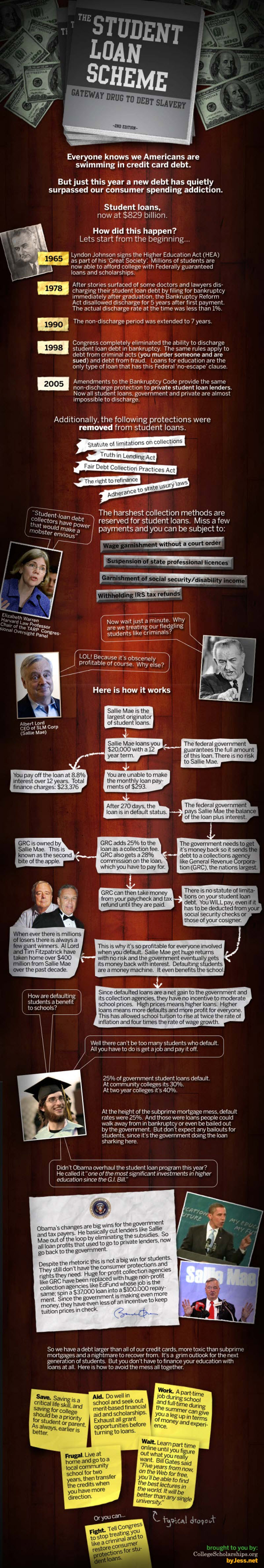

The folks at CollegeScholarships.org have published a scathing rebuke of the current student loan system. First they reiterate our point from the prior post – once upon a time, Americans were swimming in credit card debt. Today, they are drowning in student loan debt.

Their graphic represents a complete indictment of the current student loan process. By the time you are done reading you will begin to think that the entire student loan culture is designed to bilk you.

Of course, to take advantage of you, loan agencies need you to be complicit in the process. Yes, they make the entire process very enticing. But you the student (and your family) have to agree to these loans and their respective terms by placing your signature on the loan documents.

Before you do sign, be sure to pay close attention to what CollegeScholarships.org has to say. One of the most critical points centers upon the legal changes that have taken place in recent years.

Before you do sign, be sure to pay close attention to what CollegeScholarships.org has to say. One of the most critical points centers upon the legal changes that have taken place in recent years.

The result is that as of 2005, college loan debt is nearly impossible to discharge. Student loans are exempt from a number of fair practice laws: statue of limitations on collections, the Truth in Lending Act, the Fair Debt Collection Practices Act, adherence to state treasury laws and the right to refinance.

Furthermore, the harshest collection techniques are often used to collect student loan debt. They include wage garnishment (which can be done without a court order), the suspension of state professional licenses, garnishment of social security-disability incomes, and withholding your tax refunds.

All of this and a great deal more is available in the graphic. And the final piece that every student should be aware of is that 25% of all government student loans go into default. Furthermore, 30% of those students borrowing to attend community colleges and 40% of those borrowing for two year colleges go into loan default.

These figures match or exceed the numbers (25% in default) from the recent subprime home loan debacle that has crippled our economy. But in the case of home loans, a person can essentially walk away from the loan. Yes, they lose their home. And yes, their credit rating plummets.

But ultimately, they can simply turn the house over to the bank and move on with their lives. No future wage garnishments, no withholding a federal tax return, and no suspension of a state license.

On the other hand, as we noted that is not true for student loans. You cannot walk away from them – you own them for life.

It is important for students to realize that the credit card debt crisis (and the subprime loan fiasco) has spurred a whole new culture among a large segment of our population. Actually it may be new to us but in reality it is the return to the pay-as-you-go philosophy that earmarked our grandparent’s generation.

As you seek sources of funding to help pay for college think twice about borrowing. A good many people have already decided that a return to a pay-as-you-go philosophy is a good step for credit cards.

But if it is a good step for credit cards, then it is likely a must step for college. Because, as the College Scholarships.org graphic points out, those college loans will follow you everywhere.

With permission, we present the graphic here.

Thanks for the useful information. I knew that loans were milking money from students but I didn’t know they would go so far as to milk the cow after it is dead!