Time to Tax College Tuition? Pittsburgh Mayor Thinks So

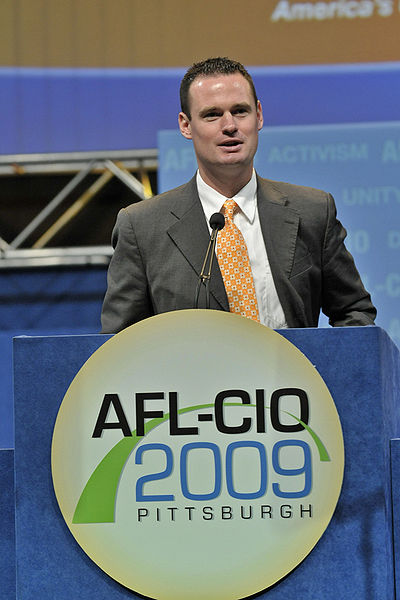

The city of Pittsburgh is abuzz over the announcement of Mayor Luke Ravenstahl’s proposed plan to institute a 1 percent tax on college tuition for the 2010 budget.

Calling the revenue enhancement the “Fair Share Tax,” Ravenstahl has estimated the proposal could raise as much as $16 million for the city. And while conservatives would insist this is just another case of taxing anything that moves, Ravenstahl sees it otherwise.

Calling the revenue enhancement the “Fair Share Tax,” Ravenstahl has estimated the proposal could raise as much as $16 million for the city. And while conservatives would insist this is just another case of taxing anything that moves, Ravenstahl sees it otherwise.

When it comes to the students taking classes within city limits, it is “the city and its taxpayers” that “bear the burden of providing them with services” states Ravenstahl. The youthful mayor goes on to claim that the “Fair Share Tax” idea is a result of his inability to fairly tax commuters and non-profit institutions.

Colleges Have Themselves to Blame

Naturally students and college officials have raised an uproar over the proposal. But as we muddle through what many experts call the greatest financial challenges since the Great Depression, state and local governments are struggling to balance their books as their revenues decline. All across the country, those same agencies, faced with enormous budget shortfalls, are making massive cuts to services. Without further revenues, those agencies will need to cut services much further over the next few years.

Meanwhile, colleges have dealt with the financial crisis by raising the cost of tuition and fees. According to web sources, at private four-year colleges, the increase was 5.9 percent over the prior year. At public four-year colleges, the increase was 6.4 percent over the prior year. Those increases simply reflect an ongoing trend that has continued unabated for the past thirty years and have critics insisting higher education has dealt with the fiscal crisis by passing the problem on to their students.

And of course, when it comes to fees, colleges and universities have written the book on how to add extra charges. Today’s typical college bill will include a lengthy list of fees from technology to student activity to labs to the parking sticker on a car, all above and beyond the basic tuition and room and board charges. Talk about taxing anything that moves.

Flat Percentage Concept

What makes the proposal so interesting to many outside the field of education is the notion that it would be a 1 percent tax on tuition. With private colleges now topping more than $30,000 a year in tuition, the tax would hit students much harder at what are often dubbed the “elite schools.”

In contrast, at community and public colleges, where tuition is much cheaper, the student assessment would be much lower. This of course has a few folks insisting that the tax may actually be fair. That stated, those who attend the wealthier schools would insist they do not consume a larger portion of the city’s services than say students from a school where tuition was much lower.

In contrast, at community and public colleges, where tuition is much cheaper, the student assessment would be much lower. This of course has a few folks insisting that the tax may actually be fair. That stated, those who attend the wealthier schools would insist they do not consume a larger portion of the city’s services than say students from a school where tuition was much lower.

The mayor has hired Joseph C. Bright, former chief counsel to the state Department of Revenue, to help pursue the 1 percent levy on tuition. Bright is on record as stating that the city will win the necessary court battle to have the tax in place for 2011.

However, one State Representative Paul Costa has announced plans to introduce a bill to put an end to the tuition tax proposal.

A Downer for Pittsburgh Students?

The levy would certainly be a major issue if Pittsburgh were the only city to institute such a tax. Seemingly, fewer students would enroll in a Pittsburgh college if such a tax were in place.

However, Inside Higher Ed has noted that Pittsburgh is not alone in discussing the idea, citing recent discussions to tax revenues from higher-education institutions in Boston, Providence, and Berkeley.

As the battle moves forward, we can be certain that the rest of the nation will be watching very closely. And we would suspect more than a few city officials across our great land, jealous of how easily colleges pass hikes onto students, could immediately move forward with proposals of their own should the concept be enacted in Pittsburgh.

I wonder if only private universities are doing this. What about SUNY/CUNY?