College Admissions

College Admissions

Preparing for College

The Best College for You

What to Study

Applications

Education Options

Education Options

Private Universities

Public & State Universities

Community Colleges

Scholarships

Scholarships

African American Scholarships

Latino Scholarships

Native American Scholarships

Women Scholarships

College Grants

College Grants

Federal Grants

Merit Based Grants

Need Based Grants

Student Loans

Student Loans

Federal Student Loans

State Student Loans

No Co-signer Student Loans

Bad Credit Loans

Student Loan Consolidation

College Survival

College Survival

Financial Aid Tips

The Digital Student Blog

Growing up, I wasn’t a big fan of playing chicken. The version we played was rather innocuous in the greater scheme of things; riding one-speed bikes at one another until someone veered away certainly represented a rather harmless version of the concept.

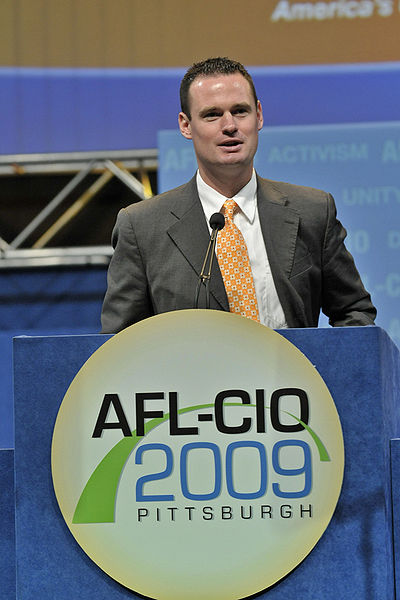

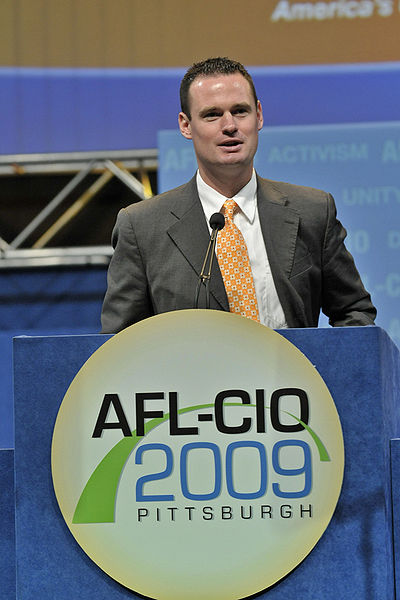

But in what was clearly a version of the longstanding game, Pittsburgh Mayor Luke Ravenstahl apparently has dropped his proposed tax request. For those not up on the issue, Ravenstahl had been seeking a one percent tax on college tuition to help offset city revenue shortfalls.

The fundamental key to the proposal was Ravenstahl’s assertion that nonprofits were falling short of paying their fair share of city costs. But according to news sources, six weeks after insisting the tuition tax was a critical component of the city’s financial future, the mayor has dropped a request that he appeared ready to pursue through the courts if need be. But in an amazing development, he stood with a group of people that included university presidents to announce he was dropping the proposal based on a promise of help from schools and other tax exempt corporations.

The fundamental key to the proposal was Ravenstahl’s assertion that nonprofits were falling short of paying their fair share of city costs. But according to news sources, six weeks after insisting the tuition tax was a critical component of the city’s financial future, the mayor has dropped a request that he appeared ready to pursue through the courts if need be. But in an amazing development, he stood with a group of people that included university presidents to announce he was dropping the proposal based on a promise of help from schools and other tax exempt corporations.

At the news conference, Ravenstahl cited a promise from the University of Pittsburgh, Carnegie Mellon University and Highmark Inc. to donate a larger sum of money to the city than they had previously pledged. In addition, he insisted that university leadership, the city council and other corporate leaders would work to craft a plan that would then be physically taken to Harrisburg (home of state government) to change specific rules related to the city’s finances.

Increasing Taxes

While raising taxes in a recession is normally deemed a political nonstarter, Ravenstahl had previously proposed a number of revenue enhancements to help the city solve its financial woes. Two publicized suggestions involved increasing the $52-a-year tax on people who work in the city and expanding a current tax on payrolls to include previously tax-exempt employers.

But it was Ravenstahl’s proposal, a first-in-the-nation 1 percent tuition tax, that has received the most attention. And while higher education in the city received significant early support in its opposition to the idea, news accounts had a significant legal battle looming, especially since a council majority appeared to be in support of the measure.

With both the city and higher education about to potentially spend exorbitant sums of money on legal expenses, it seems that the mayor may have managed to get the schools to turn away first. The developments seemed to be akin to giving in to the mayor’s demand earlier in the month for a pledge of $5 million in donations in return for dropping the tax.

In a sign that they at least understood how things might look to the public, Pitt Chancellor Mark A. Nordenberg told sources the universities were not “negotiating under the force of the pressure of the tax.” Carnegie Mellon President Jared Cohon added, “We’re not pledging a contribution in order to get rid of the tax. We are prepared to pledge a contribution as the tax is gotten rid of.”

But in a clear sign the mayor got the attention of the nonprofits, the institutions have decided to rethink their prior contribution commitments. Adding yet another feather in the mayor’s cap was the suggestion that future agreements with individual organizations will be made public.

But in a clear sign the mayor got the attention of the nonprofits, the institutions have decided to rethink their prior contribution commitments. Adding yet another feather in the mayor’s cap was the suggestion that future agreements with individual organizations will be made public.

According to blogger Mark Potter, nonprofits have not been contributing their fair share. “Some of the city’s biggest employers,” writes Potter, “its institutional non-profits, are still paying the least to support city operations.

“… until the tuition tax came along, nonprofits this year were content to shell out a voluntary donation that was less than two thirds of what they contributed back in the 1990s. Name another constituency in this city — residents, for-profit business, commuters — whose non-voluntary obligations have dropped that much.”

Tuition Tax

While state representatives have suggested that the mayor’s tax proposals were “half-baked” or “misguided,” the nation was watching the tuition tax levy very carefully. The idea has been postured in a number of other cities, particularly in light of current fiscal environments that have many state and local governments facing revenue shortfalls despite continued demand for much-needed services.

In today’s economic downturn, city governments face tea-party-like resistance to any suggestion of raising taxes. In contrast, colleges across the country still raised tuition and fees amidst the severe economic downturn.

That step certainly caught the attention of more than just the student population. Meanwhile, the subsequent events in Pittsburgh should certainly serve as a wake up call for all non-profits – ante up, or else.

Either that, or you soon will be playing a political game of chicken as well.

When it comes to higher education, there are two critical decisions to be made.

First, but not necessarily foremost, there is the choice of a specific school. A couple of weeks ago we took a look at the warning signs that you may have chosen the wrong school.

Just as important as to the decision of where to attend college there is the choice of major. In fact, in a good many cases, the choice as to area of study ripples into the selection of a school leading some to actually choose their school based a desired major.

Just as important as to the decision of where to attend college there is the choice of major. In fact, in a good many cases, the choice as to area of study ripples into the selection of a school leading some to actually choose their school based a desired major.

Yetstories abound of students changing their majors twice, three times and more. These are not tales – data indicates that approximately 70% of college students will change their college major at least once.

Perhaps you are someone who has begun considering such a change.

But you have heard that each time you change your major you may well move from a 4- to a 4.5- or even 5-year plan. That also is a statement based in fact. But your choice of major is something you really need to get right.

Here are five warning signs that you may have made the wrong choice initially.

Boring Classes

There is a saying:

A job is the place where I have to go to work to earn money. A career, however, offers the chance to follow my chosen pursuits and even get paid to do so.

When the day comes, on Monday mornings you will want to be feeling positive about the work-week ahead. While in school, the same situation applies: you should be looking forward to the classes that relate to your major field of study.

If instead you are finding your core major courses a pain, that they are flat out boring or uninteresting, then you have made a poor choice. If you are finding that you have little interest in the courses you are taking, there is little chance you will be excited about working in a profession related to that major.

Poor Grades

Most college students struggle with certain courses. After all, some classes are more difficult than others.

But most students earn their highest grades in the courses related to their choice of major.

One sign you have made the wrong choice of major is that you are struggling to handle the demands of the core courses that set the foundation for your field of study. The basic question is simple: Are your grades for the core courses in your major lower than your grades in your other required classes?

One sign you have made the wrong choice of major is that you are struggling to handle the demands of the core courses that set the foundation for your field of study. The basic question is simple: Are your grades for the core courses in your major lower than your grades in your other required classes?

If so, then you have made the wrong choice. A final transcript with poor grades in your major field of study is a red flag for employers – they will assume you are not likely to be able to bring the necessary skills to the job.

Not at All What You Thought

Now that you are in school and working on your field of study, you have a full sense as to what your major encompasses. Has that clarity reinforced or strengthened your original decision?

If you are having second thoughts, it could be that you chose your major for the wrong reasons. You may have been enticed by a hot career field or the earning potential of another option. Worse yet, you might have matched the popular choice of high school peers.

Now that you are actually involved in the coursework, is your major and area of study all you thought it would be? Is this a field that you can see yourself working in 40-hours a week, 52-weeks a year.

If not, you may have chosen the wrong major.

New Interests

Did you take an elective that brought you enormous excitement, a course where the work actually seemed enjoyable. A course where class time zipped by on a daily basis? A course that you truly hated to see come to an end?

Ultimately, the key question to ask is whether you were most content when studying the coursework in your major or did you find another area of study more appealing?

It is important that students differentiate between the course of study and the professor. It is the subject matter that we are talking about here, not how the material is presented or the ability of the professor to turn otherwise stale material into something palatable.

The bottom line is your major should be something you are excited about studying.

Changing Majors

If your sentiment matches any of the four mentioned above you would do well to review your choice. But before making the decision to change your major, be sure to think things through.

If your sentiment matches any of the four mentioned above you would do well to review your choice. But before making the decision to change your major, be sure to think things through.

First, take advantage of the services available to you on campus. Set up some time to discuss the idea further with the appropriate on-campus staff.

Begin by finding some time to connect with academic department personnel related to your initial choice as to a course of study. Then, take the time to meet with academic department personnel representing your potential new area of study.

Second, after those two discussions, take the time to seek out a counselor in the career center. Talking with a person that is independent of the two areas of study and processing your concerns with that professional can be a real help.

Most importantly, if you are not happy with your choice of major but have not yet been drawn to another field, these counselors can help provide some career assessment options. Perhaps through them you can begin pursuing some new and more interesting courses.

They can also help you walk through the ramifications of making a change. That may include any added expenses as well as whether or not the change will require the postponement of your original graduation date.

The city of Pittsburgh is abuzz over the announcement of Mayor Luke Ravenstahl’s proposed plan to institute a 1 percent tax on college tuition for the 2010 budget.

Calling the revenue enhancement the “Fair Share Tax,” Ravenstahl has estimated the proposal could raise as much as $16 million for the city. And while conservatives would insist this is just another case of taxing anything that moves, Ravenstahl sees it otherwise.

Calling the revenue enhancement the “Fair Share Tax,” Ravenstahl has estimated the proposal could raise as much as $16 million for the city. And while conservatives would insist this is just another case of taxing anything that moves, Ravenstahl sees it otherwise.

When it comes to the students taking classes within city limits, it is “the city and its taxpayers” that “bear the burden of providing them with services” states Ravenstahl. The youthful mayor goes on to claim that the “Fair Share Tax” idea is a result of his inability to fairly tax commuters and non-profit institutions.

Colleges Have Themselves to Blame

Naturally students and college officials have raised an uproar over the proposal. But as we muddle through what many experts call the greatest financial challenges since the Great Depression, state and local governments are struggling to balance their books as their revenues decline. All across the country, those same agencies, faced with enormous budget shortfalls, are making massive cuts to services. Without further revenues, those agencies will need to cut services much further over the next few years.

Meanwhile, colleges have dealt with the financial crisis by raising the cost of tuition and fees. According to web sources, at private four-year colleges, the increase was 5.9 percent over the prior year. At public four-year colleges, the increase was 6.4 percent over the prior year. Those increases simply reflect an ongoing trend that has continued unabated for the past thirty years and have critics insisting higher education has dealt with the fiscal crisis by passing the problem on to their students.

And of course, when it comes to fees, colleges and universities have written the book on how to add extra charges. Today’s typical college bill will include a lengthy list of fees from technology to student activity to labs to the parking sticker on a car, all above and beyond the basic tuition and room and board charges. Talk about taxing anything that moves.

Flat Percentage Concept

What makes the proposal so interesting to many outside the field of education is the notion that it would be a 1 percent tax on tuition. With private colleges now topping more than $30,000 a year in tuition, the tax would hit students much harder at what are often dubbed the “elite schools.”

In contrast, at community and public colleges, where tuition is much cheaper, the student assessment would be much lower. This of course has a few folks insisting that the tax may actually be fair. That stated, those who attend the wealthier schools would insist they do not consume a larger portion of the city’s services than say students from a school where tuition was much lower.

In contrast, at community and public colleges, where tuition is much cheaper, the student assessment would be much lower. This of course has a few folks insisting that the tax may actually be fair. That stated, those who attend the wealthier schools would insist they do not consume a larger portion of the city’s services than say students from a school where tuition was much lower.

The mayor has hired Joseph C. Bright, former chief counsel to the state Department of Revenue, to help pursue the 1 percent levy on tuition. Bright is on record as stating that the city will win the necessary court battle to have the tax in place for 2011.

However, one State Representative Paul Costa has announced plans to introduce a bill to put an end to the tuition tax proposal.

A Downer for Pittsburgh Students?

The levy would certainly be a major issue if Pittsburgh were the only city to institute such a tax. Seemingly, fewer students would enroll in a Pittsburgh college if such a tax were in place.

However, Inside Higher Ed has noted that Pittsburgh is not alone in discussing the idea, citing recent discussions to tax revenues from higher-education institutions in Boston, Providence, and Berkeley.

As the battle moves forward, we can be certain that the rest of the nation will be watching very closely. And we would suspect more than a few city officials across our great land, jealous of how easily colleges pass hikes onto students, could immediately move forward with proposals of their own should the concept be enacted in Pittsburgh.

As Thanksgiving approaches and the first semester enters its final weeks, now is the appropriate time for freshmen to take stock of their choice of a college. If you were like virtually every other student in America, you began the year experiencing some real feelings of homesickness. Not only did you miss the high school friends you no longer get to see, you found yourself missing that family dinner table.

Many a day you felt like an outsider. Not only was everyone older than you, they all seemed to know the routines you were still trying to figure out. Even so, you all faced yet another challenge, living with a complete stranger in a tiny dorm room that had you feeling that your privacy had been compromised forever.

Many a day you felt like an outsider. Not only was everyone older than you, they all seemed to know the routines you were still trying to figure out. Even so, you all faced yet another challenge, living with a complete stranger in a tiny dorm room that had you feeling that your privacy had been compromised forever.

All of it only added layer upon layer of stress to the significant academic demands of your classes.

But by now, if you are like most college students, you find you have picked the perfect place. You have had the chance to meet many wonderful new friends and adapted to the give and take of living with another student. Though you still feel a sense of wanting to communicate with former friends and family, you now have ample social opportunities and a host of people that help lessen the emotional tugs of those you have not been able to see.

Most importantly, you have a sense of the academic rigor and how to meet the educational demands being placed upon you. In sum total, if you are the typical student, you have been able to carve out a new place that should now feel like home.

Whereas in September and early October we would counsel patience, as Thanksgiving approaches if you have found that you still have not made any friends or are not feeling positive about college, it could well be that you did not select the right school for you. Here are five warning signs you may have picked the wrong college.

Feeling totally Out of Place Socially

Do you continue to feel out of place socially? Have you had real difficulty finding at least two other students who match your values and view regarding college?

Does your school seem to be a steady stream of parties with few folks focused in on academics? Or, does the atmosphere appear too stuffy and intense as everyone seems to hunker down and study incessantly?

Perhaps you have not found a single classmate that shares your particular religious views or who shares your interests in environmental or political issues. Maybe you feel out of place wearing Walmart jeans amongst folks who see JCrew as cheap fashion.

While it is natural to feel alone the first month or two at school, by now you should have come across a few individuals that match your values. If you truly have made a strong effort to find classmates yet still feel like an outsider, you may well have selected the wrong school for you.

The Wrong Physical Location

Were you concerned that your choice of college was going to get in the way of the friendships you began developing in early childhood? Or worse yet, did you select your school based on your desire to still be able to see a certain boy or girl?

Were you concerned that your choice of college was going to get in the way of the friendships you began developing in early childhood? Or worse yet, did you select your school based on your desire to still be able to see a certain boy or girl?

And because of those concerns, did you choose your school simply to be closer to home only now to find your high school friends showing up on campus every weekend or worse yet stopping by during the week?

Perhaps it was the opposite, in a desire to be on your own, you chose a place that put some serious miles between you and your former life. But perhaps you chose such a distance that as Thanksgiving approaches you are now stuck on campus with not enough money to fly home and too far to hop in a car and ride.

Experts advise students to be sure they choose their school based on the programs it offers and their personal academic interests. If instead you selected your school based on a specific location you may well find yourself regretting that choice.

Safety

To be at your best facing the rigors of a college education, you positively must feel safe on your college campus. If for any reason you find yourself with such concerns then you likely have made the wrong choice of school.

For different students, feeling afraid comes from very different elements. Those used to an urban lifestyle may well be uncomfortable at night walking on a rural campus where there are far fewer lights and fewer people around. For those students, the rural setting appears devoid of a truly well lit path to follow at night.

In contrast, those who have grown up in a rural setting may find the noise and the hub bub of people constantly milling around very intimidating. Such a feeling can be doubly strong when combined with an urban feel where many of the people you encounter are not necessarily fellow students.

The bottom line is your campus must feel safe to you – that includes your dorm and the walkways to and from all class buildings. And while it is easy to say buck up, fears are not easily overcome, no matter how hard you try to rationalize them.

If for some reason you constantly find yourself confined to your dorm room in fear of what lies beyond, then you most definitely have chosen the wrong college for you.

Co-curricular Activities

Did you select your school based on a desire to be part of a specific athletic team or club? If so, are you finding the activity to be everything you thought it would be?

Or is the commitment much larger than you expected? Is the focus solely on winning? Is the coach or moderator unwilling to modify practice or the scheduled meeting expectations in light of your academic workload?

Are you enjoying the activity but finding the academic setting ridiculously easy or boring? Do your professors inspire you and are you learning new skills? Or do you find yourself tolerating your academics and focusing solely on the co-curricular?

If any of these options describes your setting you may well have chosen the wrong school. Remember, the goal is to obtain a diploma and position oneself for career options.

A great co-curricular program cannot make up for a lackluster academic experience – worse yet, your co-curricular program should not interfere with your fundamental reason for attending college in the first place.

Work Is Too Easy

While at first thought it may seem better to be finding the work too easy than too hard, the harsh reality is that you are paying significant amounts of money for the opportunity to learn new things.

While at first thought it may seem better to be finding the work too easy than too hard, the harsh reality is that you are paying significant amounts of money for the opportunity to learn new things.

Perhaps you were just unlucky and got a weak professor that knows that placing demands on students also means more work for him or her.

Or maybe you have chosen the wrong level of courses and the wrong area of focus for you.

However, if you are taking five courses and you find that not one of the five is challenging you or providing you with new learning, this also reflects on the school and the assignment of courses.

Most students find the college workload adjustment significant, so challenging that they feel overwhelmed at first. That is the normal setting for students – so if you find you are coasting through your first semester you should definitely take stock of your program choice, your choice of courses, and your selection of a college.

Transferring Out

Again, after two plus months of effort you should now be settling into the place you are excited about spending the remainder of this year and the next three as well. If that is not the case, then you may well have made the wrong choice of school for you.

If you are beginning to feel as if the college you chose just isn’t right for you, the last thing you should do is pack up and go home. Instead, you need to focus in on the academic task ahead to ensure you complete the semester in good standing. There is simply too much money invested to simply give up.

In fact, most experts insist you should proceed onward to your second semester even as you begin looking at alternatives. The rationale is simple, if you stay on and prove you can handle the academics, you will be able to demonstrate that you are not simply a weak student looking for an easier place to attend school.

Those same experts insist you should stay involved in your respective activities and perhaps even seek out new ones. With solid grades and a demonstrated commitment to the task at hand, you will be more able to successfully pursue an option at another school.

Remember, the goal will be to transfer to a school that you desire, not one that will simply accept you. The fact of the matter is if you cut and run, you may well eliminate any chance of transferring to your chosen alternative.

A college degree can be affordable

Justin Pope, writing for the Associated Press, pulled no punches regarding the ongoing increase in college tuition for 2009-10. With costs rising anywhere from 4.4 percent at private schools to 7.3 at community colleges, Pope stipulated that colleges were handling the recent recession by simply passing “much of the burden of their own financial problems on to recession-battered students and parents.”

Those ever-increasing costs, consistently higher than the rates of inflation, have a number of folks questioning the value of a college degree, especially as students pile up exorbitant amounts of debt in their pursuit of a diploma. While we agree that absorbing significant debt while earning a diploma is a bad idea, we do still believe there is great value in obtaining your degree.

One only need examine the recent numbers from the economic downturn to find the necessary support for our assertion. While millions of young people are out of work, the percentage of those unemployed who have a bachelor’s degree is about half that of those without a degree.

One only need examine the recent numbers from the economic downturn to find the necessary support for our assertion. While millions of young people are out of work, the percentage of those unemployed who have a bachelor’s degree is about half that of those without a degree.

But the ultimate key is to find a way to earn that sheepskin without mortgaging your future in the process. Scholarships and grants can certainly help students on the funding side immensely, but for those with a mindset, there are a number of ways to dramatically reduce the overall costs of earning a college diploma.

Reducing College Costs

The first aspect of controlling your college costs is to simply examine the cost of tuition by school categories. Here are the numbers as reported by the College Board:

These numbers are definitely the first ones to analyze, but when looking at ways to reduce this cost, there are two critical elements to these figures.

First students must look at the cost per credit hour. When examining the published cost, students must look carefully at both the published tuition per credit hour and the latest college invention, fees that are generally listed as added costs that can raise the price burden per credit hour significantly.

Second there is the credit hour issue alone. Most degree programs require 60 hours of study for an associate’s degree and 120 for a bachelor’s. If you can reduce the number of credit hours you must pay for you can significantly reduce your cost of overall attendance.

Step One – Reducing Costs per Credit Hour

For 2009-2010, the tuition and fees at public two-year community colleges would produce a per credit hour average of about $85.00 ($2,544 in total costs divided by the average course load of 30 credits). In contrast, we see that the average cost per credit hour for in-state students would be $234 for public schools and $876.00 for private.

So the first step to controlling costs per credit hour is to examine the best way to obtain your desired degree. Simply-stated, unless you have unlimited funds for school, a well-to-do uncle or grandparent, forget about those expensive private schools.

So the first step to controlling costs per credit hour is to examine the best way to obtain your desired degree. Simply-stated, unless you have unlimited funds for school, a well-to-do uncle or grandparent, forget about those expensive private schools.

While private schools may boast of providing a better product, it is important for prospective students to understand that college is what you make of it. In fact, many of today’s top business leaders graduated from public institutions: Warren Buffett, CEO of Berkshire Hathaway attended the University of Nebraska-Lincoln. H. Lee Scott, the CEO of Wal-Mart Stores, attended Pittsburg State University in Kansas while James Sinegal, the CEO of Costco Wholesale attended San Diego City College.

Therefore, the first way to manage you college costs is to attend a public college, generally a campus of your state university system. I know: that just might not sound so exotic when you are discussing the topic with family and friends. But it is important to realize that exotic costs bigger bucks.

Second, if you truly want to minimize costs yet obtain a diploma, the most cost-effective road would be to earn your first 60 credit hours (years one and two) at a local community college, then transfer to a public state university school for your final 60 hours (years three and four). Even attending community college for one year would represent an enormous reduction in college costs.

There would no doubt need to be some initial homework to determine which community college credits would be transferable upon matriculation at a state school. You might even have to do some negotiating, but many of the mundane course requirements of any degree program could certainly be addressed at a community college. And if you find a course will not transfer, don’t take it. Save your funds for later. All total, with a little effort you could knock off more than a year’s worth of the higher-priced tuition costs.

Step Two – Reducing Credit Hour Costs

The second way to dramatically decrease your college costs is to reduce the number of credits you must pay for at the required tuition rate. There are almost an unlimited number of ways to reduce the number of credits that you must shell out funds for, but a good many of them must be accessed while you are still in high school.

For example, taking Advanced Placement courses can result in potential college credit. Such courses are often available at your local high school either by direct instruction or through the school in online format.

Students gain access to college-level curricula and upon completion of the material may take an exam to determine mastery. Passing that exam can provide college credit at a large number of colleges across the country.

Students may also take the College-Level Examination Program® (CLEP) tests in 34 different subject areas. These exams, at $72.00 per test, can provide anywhere from 3-12 credits at certain colleges at a fraction of the cost.

Today, many local colleges also offer courses to high school students in their area free of charge (referred to as early college). Again, given the cost per credit hour, students should investigate such options extensively and take advantage of what is available.

In all instances, including the possibility of seeking life experience credit for a work portfolio, the key is to do one’s homework up front. That means sitting down with college officials to review what credits the school will accept when a student does enter that respective institution.

For example, some schools will not accept AP classes whatsoever. Others will allow credit only provided students score a four or five on the exam (even though a three is considered a passing score).

While in college, another very distinct option to reducing credit-costs is referred to as the co-op or internship experience. Here again, the concept is dependent on the school one attends.

Co-op and internships provide students practical learning skills in a specific field through the use of work placements. In such programs, students may receive either pay or course credit for their time. If the experience is in your field of study, the work-related insight one gains is incredibly valid for one’s future career.

At the same time, many such experiences also offer college credit when students combine the proper reflection and academic review to the work experience. In certain instances, these experiences serve as a triple benefit, providing some cash to help pay the bills, some college credits to reduce the number that must be paid for, and even the possibility of potential job placement opportunities that can form as a result of the connections one makes while performing their service.

Reducing Miscellaneous Expenses

In addition to the tuition costs, students face a number of other related expenses while working towards that diploma. Such costs include room and board, books and supplies, and travel expenses.

The bottom line is these costs cannot be categorized as mere incidentals, certainly not when repeated over a four-year period. Once a school is chosen, tuition costs are set but students still have decisions that can greatly reduce the incidentals that accompany tuition costs.

Step Three – Eliminate the Room and Board

One way to reduce your four year college outlay is to rethink the idea of room and board. While many cringe at the thought, it is imperative that students understand the current going rate for room and board is now $8,193 at public colleges and considerably more at some private, elite schools.

Examine that number carefully – it is more than the average cost of tuition at four-year public schools. And it is more than triple the average tuition costs at a two-year community college.

Examine that number carefully – it is more than the average cost of tuition at four-year public schools. And it is more than triple the average tuition costs at a two-year community college.

Now spread that out over four years – a total of more than $30,000!

The simplest way to reduce this expense is to live at home. Such a decision becomes a possibility if you consider the community college/state university combined four-year plan we mentioned earlier. It certainly becomes viable if you consider community college for the first two years at a minimum.

If your home residence is simply too far away, you also need to carefully assess the school rates for both the housing and the meal aspects.

It could well be far cheaper to lease an apartment or house, especially if you can find others to share that cost.

In regards to meals, most school plans represent a significant cost per meal. In addition, missed meals seldom produce anything in the way of refunds if you do not access them. So when purchasing any meal plan, be sure it is a plan you will access.

There is no doubt that living at home limits one of the indirect benefits of college, the activities available and the connections made on-campus. To obtain those experiences, students will have to work harder at this element. But the experiences are available to all students, even if you are not residing on campus.

Step Four – Distance Learning Courses

Once available primarily at for-profit institutions, online learning is now available at a multitude of schools including state university systems. Completing one or a number of online courses can greatly impact your miscellaneous expenses.

We noted earlier the need to take into consideration fees when calculating tuition costs. Online courses often allow students to be exempt from a number of facility and campus-related fees such as student activity, campus access and technology fees. At one Florida school that lists tuition costs as $50.00 per credit hour for in-state students, those costs move to $150.00 per credit hour when all the fees are factored in.

In addition to potentially eliminating these on-campus fees, online courses also eliminate travel expenses and room and board entirely. They also can be a key component of our final savings step.

Step Five – College in 3.5 or 3.0 Years

While tuition costs are per credit hour and programs mandate a specific number of credits, miscellaneous expenses occur each semester. So one of the simplest ways to reduce total outlays is to reduce the number of semesters you are at school.

That reduction can of course come from the aforementioned reduction of credits needed. It is for this reason that AP courses, CLEP tests, Co-Op programs and Internships compound your savings, reducing costs at both levels.

But it can also come from taking additional courses each semester. Taking one extra course, either via online methods or simply taking another traditional class, for just five semesters will reduce your program from 4 to 3.5 years. Taking two online courses each summer and one extra traditional class each semester could reduce your college program to 3 years. Prerequisites can make this a challenge but with a little effort you can reduce the standard four-year program.

But it can also come from taking additional courses each semester. Taking one extra course, either via online methods or simply taking another traditional class, for just five semesters will reduce your program from 4 to 3.5 years. Taking two online courses each summer and one extra traditional class each semester could reduce your college program to 3 years. Prerequisites can make this a challenge but with a little effort you can reduce the standard four-year program.

Remember, such steps would carry tuition costs per credit hour, but they would greatly reduce the costs of room and board and those incidental traveling expenses associated with attending school.

Control Your Expenses and Earn Your Degree

While costs are growing substantially, it is important for students to know that out-of-pocket costs have trended down in recent years. In fact, while tuition and fees have risen as much as 20% since 2004, the average net price of college has dropped over the last few years.

The reason is the greater availability of grants, financial assistance and tax benefits.

Of course such developments make it all the more enticing to consider our steps to cutting the costs of college. According to a recent Time article, the increased aid development means that the “average student at a two-year college or university pays nothing in tuition and fees and collects about $500 toward living expenses.”

Of course, marketing is what drives the business world – if you package your product well enough, people will seek to acquire that product at all costs.

Generally speaking, all colleges have taken advantage of this concept. But some, specifically those elite private schools, have done so to the extreme.

The result is far too many students are being enticed, taking on ridiculous levels of debt as they attempt to obtain a diploma from a school they simply cannot afford. It is time that students, as well as their parents, went back to the old school adage, finding a quality product at a price they can afford.

With a little work and a certain level of sacrifice, students can earn that coveted diploma without mortgaging their entire future in the process.

Five reasons why the aid act may be bad for students.

There has been a pause in Washington as all eyes focus in on the healthcare debate. But very soon the Senate will be taking up an important measure related to college students and financial aid that was previously approved by the House.

TheMiddleClass.org offers the following summary of that bill, The Student Aid and Fiscal Responsibility Act of 2009:

The Student Aid and Fiscal Responsibility Act terminates the Federal Family Education Loan program, which provides subsidies and guarantees to private lenders that make student loans. Instead, the federal government would issue student loans directly to borrowers. Ending the subsidization program would save the government $87 billion over ten years. The Act ensures that interest rates on student loans remain affordable. Additionally, the legislation increases the maximum Pell Grant, a need-based grant designed for lower-income students, from $5,350 in 2009 to $5,550 in 2010 and $6,900 in 2019.

The Student Aid and Fiscal Responsibility Act includes funds for programs to encourage completion of college and subsequent employment, particularly for students from underrepresented backgrounds; for Historically Black Colleges and other minority-serving institutions; for early-childhood education; and for school modernization and repair. The bill also provides funds for improving the community college system. The legislation simplifies the Free Application for Federal Student Aid (FAFSA), which determines eligibility for student aid.

Such a summary has most folks taking the stance that the recent approval of the legislation by Congress is a massive step forward for students and families. As but one example, the Seattle Times offered extremely high praise, noting that “Congress’ overhaul of the college student-loan system offers welcome relief to students at risk of drowning in debt.”

College students backing SAFRA recently put together a YouTube video:

Certainly the legislation borders on the historic. Terry Hartle, senior vice president at the American Council on Education, indicated that the legislation “is the biggest change in federal loans for higher education since 1965, when the original program was created.”

But those following the issue realize that support for the legislation is falling along party lines: Democrats in support, Republicans in opposition. Therefore, one can quickly surmise that the new program conflicts with certain conservative principles.

Perhaps even more importantly, as the legislation becomes clearer many others, irrespective of party affiliation, have begun questioning this massive change. Indeed, after listening to those critics, we too have begun to wonder aloud.

Is the legislation really a positive step for students and their families?

Issue One – Categorizing the Middle Man as a Corporate Monster

One highly touted aspect of the legislation is the move to make the federal government the direct lender to students. In taking this step, the goal is to remove the so-called ‘middlemen’ from the loan process.

Banks are certainly pushing back, after all college loans have served two purposes. The interest on the initial loan is but one positive element for banks. A second and perhaps larger segment has to be the opportunity to create new customers.

But while most equate banks and profits with the middlemen term, the fact is there are many local agencies handling the loan process for students. Most are nonprofits, working to ensure that the loan process, from borrowing through repayment, goes smoothly.

The legislation as currently enacted eliminates all agencies handling these funds including some highly-valued nonprofits. For example, one such nonprofit, the New Hampshire Higher Education Assistance Foundation (NHHEA), works with nearly 30,000 New Hampshire students and parents each year, offering free college planning and information related to financial literacy and financial aid.

But under the proposal, intuitions such as NHHEAF would also be eliminated.

Issue Two – A Potential Increase in Loan Defaults

As noted previously, these local nonprofit centers focus on educating students in all financial matters. They not only offer financial literacy programs for student borrowers and financial aid preparation for students and their families, they also offer programs that promote early college awareness.

Such training goes a long way in terms of developing greater student understanding of the loan process. As but one example again, NHHEAF can claim one of the lowest default rates in the nation.

Needless to say, this loss of local services could well mean far more in the way of potential student loan defaults.

Issue Three – No Savings for Students or Families

Clearly there is major support for “eliminating subsidies to lenders,” particularly after what has transpired over the last year in the financial world and the role banks have played in it. But upon hearing of the elimination of these subsidies, the public immediately assumes the result will be a reduction in program expenses.

It appears instead of passing along savings to students, the current proposal may well cost students more. According to the Chronicle of Higher Education, the “federal government isn’t providing any breaks to the students” and ultimately will be making more off the program than lenders ever could.”

It may well be that the money raised will be doled out in the form of increased Pell Grants, but those grants will essentially be funded from students paying off other loans, not necessarily from increased support from the federal government.

In addition, those schools currently utilizing other loan programs will need to invest staff, time and money to change systems and processes. This would need to take place at the same time that schools have axed budgets to the bare bones.

The costs associated with implementing the program will likely be passed on to students through increased tuition and student fees.

Issue Four – Handling the Increased Demand

The legislation by Congress assumes that the government can effectively and efficiently step up and run the new program. According to Martha Holler, a spokesperson for Sallie Mae, in order to implement the proposal, “about 4,500 schools would have to convert lending systems. It’s not like putting a different disk in their PC; the whole system has to be reworked.”

The result, “The U.S. Department of Education will be tasked with converting an average of nearly 500 schools a month over the course of a nine month period,” notes Tara Payne, Vice-President of Corporate Communications for NHHEAF. “Since the Direct Loan program’s inception in 1993, roughly 1,600 schools have been converted over a 16 year time-frame.”

The result, “The U.S. Department of Education will be tasked with converting an average of nearly 500 schools a month over the course of a nine month period,” notes Tara Payne, Vice-President of Corporate Communications for NHHEAF. “Since the Direct Loan program’s inception in 1993, roughly 1,600 schools have been converted over a 16 year time-frame.”

Issue Five – Increasing the National Debt

According to the Office of Management and Budget (OMB), under budget proposals that include the switch to 100-percent Direct Lending, the debt held in the Government’s various Direct Loan accounts is expected to rise from $632 billion in FY 2009 to $1.58 Trillion in FY 2019, an increase of more than $900 billion. Therefore, nationalizing the direct loan program will add substantially to the national debt over the next decade.

This means that those who benefit from the loans will actually pay twice, once when paying off the original loan and a second time when he or she pays the taxes necessary to eliminate the ever increasing national debt.

Of course some insist that the basis of the proposal is to deal with the larger budget issues, that any savings created by program changes will be used to plug budget gaps instead of providing additional funds for higher education.

Questioning the Change

These five issues have us and others questioning the government take-over of a public-private program that has seemingly supported students and schools, especially those who have borrowed judiciously in the past.

How College Sports Continues to Sell its Soul.

I cannot remember the first time I heard someone suggest Division I athletics bordered on a form of prostitution. Though previously I had deemed such a suggestion excessive hyperbole, this past weekend we became witness to why that ugly word is used to describe college athletics.

On Saturday, Delaware State, a small 1-AA FCS football program, had the unenviable task of traveling up to Ann Arbor to take on the 1-A FBS Michigan Wolverines. As expected, the game, which should never have been played, was a rout of monumental proportions.

The Wolverines (5-2) set several team records including 442 total yards of offense in the first half and 727 for the game in a 63-6 rout. Michigan matched a school record by scoring 28-points in the first quarter and their 49 points by halftime were the second-highest in school history.

The Wolverines (5-2) set several team records including 442 total yards of offense in the first half and 727 for the game in a 63-6 rout. Michigan matched a school record by scoring 28-points in the first quarter and their 49 points by halftime were the second-highest in school history.

But truth be told, such routs happen quite often in the world of college athletics, particularly in football when teams with disparate resources get together to ‘compete’ on the field. Therefore, in most instances, the Michigan-Delaware State game would simply be relegated to the NCAA hinterlands if not for a back story that demonstrates the sometimes vile world of college athletics.

Two Losses the Same Day

Sports sites noted that Delaware State actually lost two football games on Saturday. In addition to the pasting they received at the hands of Michigan, the team forfeited a game against fellow Mid-Eastern Athletic Conference foe North Carolina AT&T, a game that had been scheduled prior to the agreement to play Michigan.

In fairness, the initial mistake of two games being scheduled on the same date came while Delaware State was searching for an athletic director. But the choice of what game to play, and subsequently which to forfeit, demonstrates why so many are down on the world of college athletics.

Seems that Delaware State was offered $550,000 to go to Ann Arbor and play the role of football fodder for the Wolverines. And administration at the school decided that sum of money was just too much to pass up.

The Decision

According to reports, given the opportunity, Delaware State signed a contract to play the game in Ann Arbor despite having already committed to playing AT&T on the same date. The contract did allow Delaware State to cancel for a fee, the amount of which was not made public.

Of course, once everyone realized a mistake had been made, Michigan could have done a classy thing and released Delaware State from the contract. But then again, if Michigan could afford to pay Delaware State $550,000 just to appear, one can gather that the lost revenue from a home game would represent a sum of money that made the half-million payout seem inconsequential..

Of course, once everyone realized a mistake had been made, Michigan could have done a classy thing and released Delaware State from the contract. But then again, if Michigan could afford to pay Delaware State $550,000 just to appear, one can gather that the lost revenue from a home game would represent a sum of money that made the half-million payout seem inconsequential..

At the same time, Delaware State officials could have done the right thing and honored their league commitment against AT&T. Of course, given Michigan’s stance, to do so meant State would have had to pay the required fee for backing out.

Instead of either school honoring the spirit of amateur athletics, i.e. handle a loss with dignity and class, both opted for the opposite. Both put large sums of money in front of integrity and, as a result provided a sorry message to the athletes on their respective teams.

Many Fumbled the Ball

Beyond the physical mismatch that constituted the so-called ‘game’, the decision by Delaware State to take the money also meant it put the integrity of its league at risk. The choice to forfeit could well impact the final league standings and ultimately, the status of numerous other conference teams in the process.

Given that both levels of football have a supervisory agency, the NCAA, one would think that leadership beyond the two schools would have taken issue with the decision to allow money to alter the integrity of the sport. Apparently, not so.

Today we understand why some would use the word prostitution to describe college athletics. Yes, such a statement borders on the outrageous.

But what these two universities did in the name of college football could only be described in such terms.

We have frequently highlighted the roll of social media in college, even when it turned out to be a bad fit. Some professors have taken a liking to it, particularly note passing on Twitter. Going one step further, College Scholarships is incorporating Twitter into a scholarship now. Students may enter the 140 Scholarship by Tweeting their answer to the following question “how we Twitter be used to improve the world?”

It is deemed to be one of the “most popular courses in Harvard’s history.” And now, thanks to WGBH television and Harvard University, every American has an opportunity to examine the moral and ethical issues that form Michael Sandel’s course “Justice.”

In opening this classroom to the world, Harvard gives us a taste of the future of higher education. With the proper preparation and a gifted-instructor, the course is proof-positive that high quality education can be delivered online.

In fact, one might honestly ask, what is the advantage of actually being seated in the auditorium where Sandel teaches. The incredible numbers of students eliminate any intimacy and any real possibility of discussion within the “classroom setting,” i.e. stadium-style lecture halls.

That said, the critical components of the twelve-part series are the content and the complex moral questions being posed. Addressing the hot topics of our day (affirmative action, same-sex marriage, patriotism and rights), Sandel offers a constant stream of provocative questions that provide for outstanding discussion opportunities.

As but one example of how to use content to drive instruction, in episode 2, How to Measure Pleasure, Sandel offers video clips from three distinct and different elements of the entertainment world: clips from Shakespeare’s Hamlet, the reality show Fear Factor, and The Simpsons.

The course also features opinion polls, pop quizzes, in-depth readings and discussion guides offering two levels of debate, beginner and advanced depending on your current background.

As for one rationale for the online version exceeding the traditional classroom model, online classes now offer literally endless possibilities for rich discussions with viewers from around the world. Not only are such discussions impossible in the auditorium where the class is presented, online discussion forums remove the need for students to gather collectively on a single campus.

The two drawbacks? First, there is that same mentality that features the typical time constraints of all education, materials are being released weekly.

Second, the method for earning those all-important credits that can be collected to earn a college diploma.

But as for the model of what could be, Justice is the real deal!

By all accounts, the job placement data for the Class of 2009 was exceedingly dismal. While everyone is hopeful of a better future and most signs point to an economy on the rebound, career experts insist that the Class of 2010 could well see similar job placement challenges.

The reason is quite simple – it seems that the poor 2009 job placement rates came in great part because a large number of 2008 graduates had been unable to secure a job in their field. Now, the Class of 2010 faces a double whammy, the cascading effect of two consecutive poor placement years.

Therefore, even as the economy turns the corner, next year’s grads will be competing with a number of currently unemployed folks for the few additional jobs that become available.

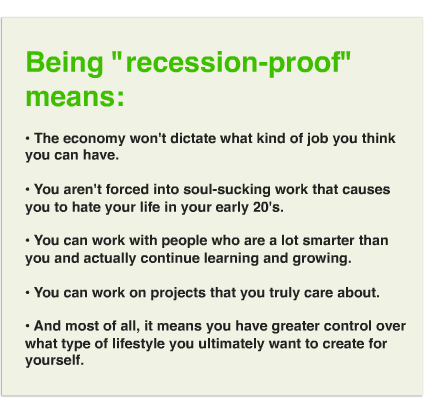

Becoming a Recession Proof Graduate

Given this sobering scenario, today we turn to Charlie Hoehn, the author of the interesting SlideShare ebook, “Recession Proof Graduate.” A 2008 graduate of Colorado State University, Charlie holds degrees in marketing and media studies.

Currently touring the country with Tucker Max during the screening of his new movie: I Hope They Serve Beer in Hell, Charlie continues to work with Ramit Sethi, a partnership that led to Sethi’s recent book becoming a NY Times and Wall Street Journal best-seller, and with Tim Ferriss, author of the NY Times best-seller, The Four-Hour Workweek.

Currently touring the country with Tucker Max during the screening of his new movie: I Hope They Serve Beer in Hell, Charlie continues to work with Ramit Sethi, a partnership that led to Sethi’s recent book becoming a NY Times and Wall Street Journal best-seller, and with Tim Ferriss, author of the NY Times best-seller, The Four-Hour Workweek.

Charlie provides some pretty radical advice in Recession Proof Graduate. After reading his recommendations, we wanted to give Charlie some time to discuss his job search process, particularly his decision to throw out the traditional search model after seeing conventional techniques produce dismal results for him.

In your book, you talk about your initial job search upon graduating and the difficulties you had. At some point you came to the realization that the recession was not the issue, it was your use of conventional job-hunting methods and your expectations related to that search. Which realization came first, the need to change your expectations or your need to try a new search technique?

The need to change my expectations definitely came first. After I got turned away from a company I’d interned with for three months (and they LOVED me, by the way), I kinda knew the odds of me finding a well-paying, fun job were pretty slim. I changed my job hunting tactics later on out of sheer desperation, after trying the traditional methods for a few months and seeing godawful results.

You certainly turn one standard goal of the job search process on its head. Can you explain why the goal for graduates should not be focused so much on making loads of money?

I’m all for making a lot of money, but I knew that I didn’t necessarily deserve a big paycheck right away. I had to earn that right. So I think the goal for graduates should not be to immediately find a high paying gig, but rather to figure out how to maximize their potential future earnings. This can be done by learning in-demand skills, doing free work for specific people, etc. This way, you’re setting yourself up for making more money in the long run, while also making yourself more valuable as an employee and building your network.

Another reason I don’t think grads should be too focused on money is because it will REALLY force you to figure out what your priorities are. I have a few friends who jumped into industries they don’t like because they were tempted by the promise of $60-80K in the first year on the job. Even I played with the idea of being a landman for an oil and gas company because I would have made $70K straightaway. But I also would have quickly grown to hate my life. And after a certain point, I would have been so emotionally and financially dependent on that big paycheck that there’d be no turning back. It’s far better, I think, to do free work for a few months. You’ll figure out what you truly want to do.

Another reason I don’t think grads should be too focused on money is because it will REALLY force you to figure out what your priorities are. I have a few friends who jumped into industries they don’t like because they were tempted by the promise of $60-80K in the first year on the job. Even I played with the idea of being a landman for an oil and gas company because I would have made $70K straightaway. But I also would have quickly grown to hate my life. And after a certain point, I would have been so emotionally and financially dependent on that big paycheck that there’d be no turning back. It’s far better, I think, to do free work for a few months. You’ll figure out what you truly want to do.

And really, should a student consider throwing away their resume?

Maybe not literally, but I do think resumes suck. Just from an aesthetic standpoint, I think resumes are awful. They all look the same — plain and boring — and when you consider that you’re in a pile with dozens (and sometimes hundreds) of other resumes, you have to realize that it’s nearly impossible to stand out. The average graduate will not have any remarkable credentials under his belt, so how is he going to beat out all these other faceless resumes? He won’t. So I say throw away your resume. A one-page document shouldn’t represent your past, present, and future. A blog or a portfolio are superior alternatives, and they can vividly illustrate a person’s thought process and skills.

The idea of working for free to obtain critical experience and skills isn’t really new is it? Is this not just the concept of an internship? And, didn’t you get the skills you needed in college?

Free work is very different from an internship, as Seth Godin pointed out. Free work allows you to work on your own terms: you get to work with the people you want to, on the projects you want to work on, in the industry you want to work in. The relationships with the people you work for will develop organically, and they won’t look at you as just an intern — they’ll actually want to help you learn and grow.

Did I get the skills I needed while I was in college? Yes and no. Yes, because all of the skills I’m currently hired and paid for were things I taught myself while I was in college. No, because college didn’t really teach me any new skills that employers would want to hire me for. College gave me a degree, a GPA, and four years of fun memories. None of those hold much weight in a recession.

In your ebook you explain that many folks insist that you have this new job search process all wrong – one honest fear of some of the folks I have talked to is that once you work for free that will become the ongoing expectation – how do you respond to folks who raise this concern?

I briefly addressed this at the end of the e-book. It’s all about managing expectations. If you don’t lay down a deadline for when the free work transitions to paid work (or introductions to other people, new opportunities, etc.), then you’re setting yourself up to be taken advantage of. Most people who take you under their wing to do free work will be more than willing to reciprocate and help you out if you do a really great job, but you need to make that clear upfront. I’ve done free work for a bunch of people over the last year and a half. I only felt like I got burned once, and that was when I did work for a struggling entrepreneur who was working on his first startup (which is why I recommend that graduates work for successful entrepreneurs).

I also try to work with people who are dependent on maintaining a strong, healthy personal brand online. I’ve built up enough credibility and have enough followers that it’s a bigger liability for them if they take advantage of me. This is not to say I would ever hold this over their head, or threaten them with it if things started to go poorly. Rather, it’s just to point out that it’s in their best interest to take care of me (which they do).

One key element is the suggestion to seek to do this free work virtually – why is this a point of emphasis in the process?

Doing work virtually really frees you up to work with anyone you want — you’re not limited to whatever local opportunities are available. You can work with people in other states, or other countries. Virtual free work is probably the best dynamic for graduates, because you can take on a bunch of projects all at once and choose which ones you want to continue pursuing. There’s very little risk involved for the employer (no money spent, no time wasted training), and there’s very little risk for the graduate. What’s the employer going to do if you screw up? “Fire” you? Probably not — you’re not eating up their payroll and you’re not using much of their time either. Even if you do end up parting ways, it’s not the end of the world.

You not only talk about the importance of a person’s online presence, you honestly inform folks that your initial online presence did not portray you in a very flattering light. Can you explain to readers what your initial presence looked like and the process you used to bury the negative elements to the Google hinterlands?

What shows up in Google when you search for someone’s name is a little different from having an online presence. A few years ago, I had a Facebook and LinkedIn account — technically, that’s an online presence. But when you searched for ‘Charlie Hoehn,’ a CollegeHumor video of my friend riding his bike drunkenly down a flight of stairs (and crashing) was one of my top 5 results. Another one of my top results was an online article from CSU’s newspaper where I was quoted talking about abortion. My old Google results didn’t really give any employer much to work with in terms of figuring out what I’m like or whether I’d be worth hiring.

What shows up in Google when you search for someone’s name is a little different from having an online presence. A few years ago, I had a Facebook and LinkedIn account — technically, that’s an online presence. But when you searched for ‘Charlie Hoehn,’ a CollegeHumor video of my friend riding his bike drunkenly down a flight of stairs (and crashing) was one of my top 5 results. Another one of my top results was an online article from CSU’s newspaper where I was quoted talking about abortion. My old Google results didn’t really give any employer much to work with in terms of figuring out what I’m like or whether I’d be worth hiring.

I had to start a blog for the virtual internship I did with Seth Godin (I never planned on having one). Eventually, people started to link to me and actually write about me, for whatever reason. And all of those posts started to accumulate and bury my negative Google results. It wasn’t actually an intentional process to put me in a positive light online — it just sort of happened on its own.

How long did this process actually take?

I’m not entirely sure, but I want to say it was between 2-4 months before I had control of the top 5 search results for my name. It took a few more months to really get a stranglehold on the top 10 results. I have a fairly rare last name, so I’m sure it will take a lot longer for some people.

Your advice about starting a blog to help define your online brand comes with a couple of cautions – talk a little bit about those cautions.

A lot of people, especially graduates, make a huge mistake when they start blogging: they’re honest to a fault. They treat their blog as a personal diary, where they can talk about their alcoholism, or their inability to talk to women, or whatever other shortcomings they have. If you want to do that, go find an anonymous forum or something. Don’t do it on your personal blog if you’re legitimately trying to use it as a tool to get hired. You want to paint an honest yet flattering picture of yourself, so be professional.

Quality of content is also HUGELY important. If you write up something half-assed and you know it’s not very good, don’t post it. I think it’s more of a liability to have a bad blog than it is to have no blog at all. You can talk your way out of mediocre search results, but if the writing on your blog sucks, you can’t really dig yourself out of that hole.

Quality of content is also HUGELY important. If you write up something half-assed and you know it’s not very good, don’t post it. I think it’s more of a liability to have a bad blog than it is to have no blog at all. You can talk your way out of mediocre search results, but if the writing on your blog sucks, you can’t really dig yourself out of that hole.

Two really key elements of your philosophy are to choose the right person to work for and to choose projects you really care about. Can you talk a little bit about the characteristics you focus in on when deciding which person or industry to target?

I have several questions I ask myself when deciding whether I want to work with a person or not:

• Does this opportunity excite me?

• Is it going to be fun, challenging, and intellectually stimulating? i.e. Will it help me grow as a person?

• Will more opportunities open up to me when this is over?

• Can I learn a new skill set if I work with them?

• How flexible will my schedule be if I take this? This is important, because if it’s a huge time-kill, I won’t take it.

• Is this person a successful entrepreneur? If no, proceed with caution. Entrepreneurs who have never succeeded are a big risk, and are usually too poor to ever pay much. They’re fun to work with, but it’s usually not worth the time.

• How well does it/will it pay?

There aren’t many criteria for deciding which industry to target. Basically, I just go after the ones that look the most fun.

When contacting potential targets, you rightfully note the need to do some intense homework on the target. You then note that that the student should suggest specific examples of free work he/she could do that will have a measurable impact on the targeted business. My fear is that this would come off sounding a bit presumptuous to the recipient?

It’s hard to approach an employer with some vague description of what you can do for them or, even worse, saying you’ll help out however you can. It’s too broad and vague, so it’s hard for them to visualize how you’d be an asset. But if you lay out in specific terms how you think you can help them, and give them a few suggestions, it helps them fill in the gaps. You won’t force them to rack their brain on how they can use you. Instead, you’re helping them visualize how you’ll fit into the picture. Trust me, they’ll be very impressed that you brought a list of ways in which you could help.

It’s hard to approach an employer with some vague description of what you can do for them or, even worse, saying you’ll help out however you can. It’s too broad and vague, so it’s hard for them to visualize how you’d be an asset. But if you lay out in specific terms how you think you can help them, and give them a few suggestions, it helps them fill in the gaps. You won’t force them to rack their brain on how they can use you. Instead, you’re helping them visualize how you’ll fit into the picture. Trust me, they’ll be very impressed that you brought a list of ways in which you could help.

Can you give our readers a sense of a how you used this strategy to land some critical first opportunities?

Everyone I’ve approached for work in the last year has hired me because I laid out how I could help them specifically. Ramit Sethi was the first person I used this strategy on, and he eventually introduced me to Tim Ferriss. I gave Tucker specific examples of how I could help him, as well. Giving suggestions shows your initiative, and your willingness to emotionally commit to a job before you even get it. Try it, you’d be surprised at how effective it is.

Photos courtesy of Charlie Hoehn.